Despite a Volatile December For Bitcoin, Bullish Signals Are Emerging: VanEck

Bitcoin Magazine

Despite a Volatile December For Bitcoin, Bullish Signals Are Emerging: VanEck

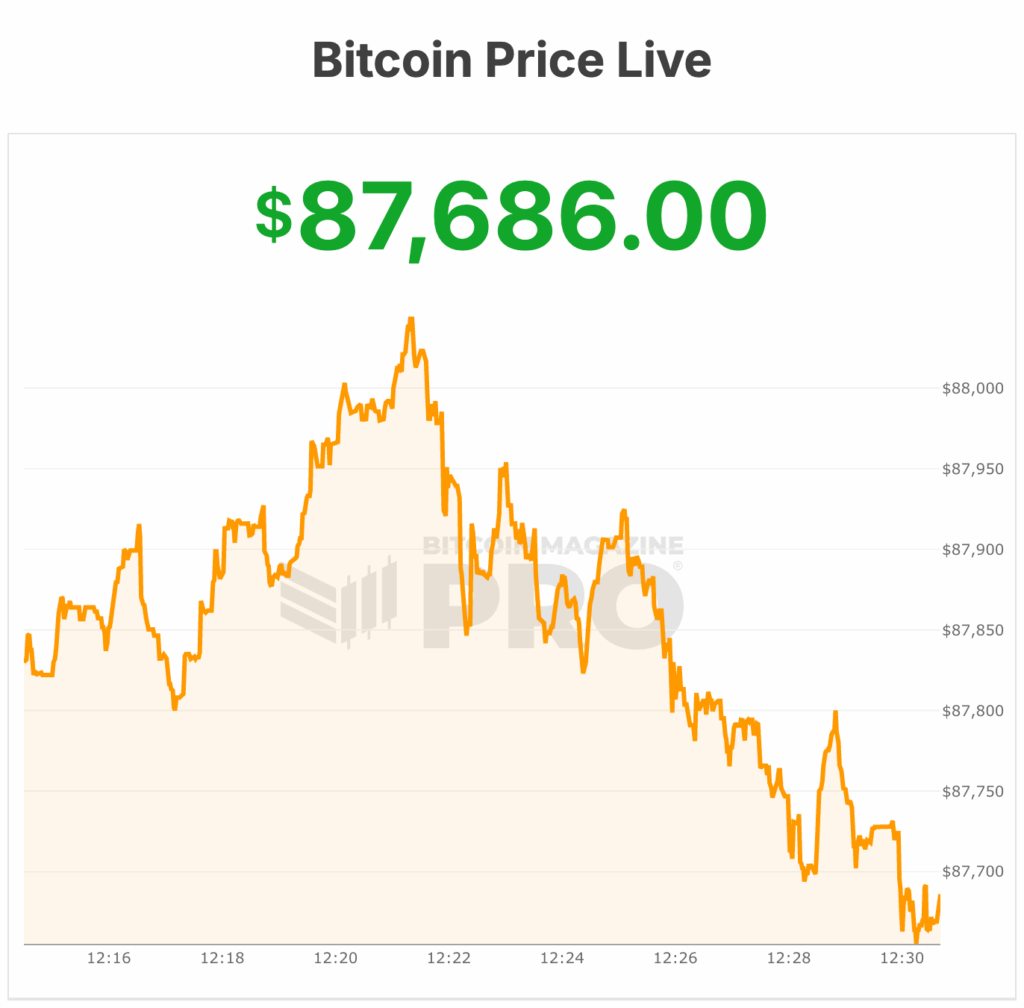

It’s been a turbulent and volatile fourth quarter for Bitcoin in 2025. BTC has endured a turbulent December, with prices dropping nearly 9% and volatility spiking to levels not seen since April 2025.

In its latest mid-December “ChainCheck” report, VanEck’s digital asset analysts painted a nuanced picture: while on-chain activity remains weak, liquidity conditions are improving, and speculative leverage appears to be resetting, offering cautious optimism for long-term holders.

The firm highlighted the contrasting behaviors between different investor groups. Digital Asset Treasuries (DATs) have been actively buying the dip, accumulating 42,000 BTC — their largest addition since July — bringing aggregate holdings above one million BTC.

This contrasts with Bitcoin exchange-traded product (ETP) investors, who have reduced exposure, underscoring a shift toward corporate accumulation over retail-led speculation.

Analysts at VanEck noted that some DATs are exploring alternative financing methods, including issuing preferred shares rather than common stock, to fund purchases and operations, reflecting a more strategic, long-term approach.

Onchain data also revealed a divergence between medium- and long-term holders. Tokens held for one to five years have seen significant movement, suggesting profit-taking or portfolio rotation, while coins held for more than five years remain largely untouched.

VanEck interprets this as a signal that cyclical or shorter-term participants are offloading assets, whereas the oldest cohorts maintain conviction in Bitcoin’s future.

Bitcoin miners are facing a falling hashrate

Miners, meanwhile, have faced a particularly challenging environment. Network hash rates fell 4% in December, says VanEck — the sharpest decline since April 2024 — as high-capacity operations in regions such as Xinjiang reduced output amid regulatory pressures. Breakeven electricity costs for major mining rigs have also dropped, reflecting tighter profit margins.

Historically, however, VanEck notes that falling hash rates can serve as a bullish contrarian indicator: periods of declining network power have often preceded positive 90- to 180-day forward returns.

The VanEck team frames its analysis within the GEO (Global Liquidity, Ecosystem Leverage, Onchain Activity) framework, designed to assess Bitcoin’s structural health beyond daily price fluctuations.

Under this lens, improving liquidity and the accumulation by DATs provide a counterweight to softer on-chain metrics, including stagnating new addresses and declining transaction fees.

Broader macro trends add complexity to Bitcoin’s outlook. The U.S. dollar has weakened to near three-month lows, rallying precious metals, but Bitcoin and other crypto assets have remained under pressure.

In parallel, the evolving financial ecosystem may offer new support. Market observers point to the rise of “everything exchanges,” platforms aiming to integrate stocks, crypto, and prediction markets, leveraging AI-driven trading and settlement systems.

Just last week, Coinbase made an ‘everything exchange’ like move and launched an expansion of its platform, introducing stock trading, prediction markets, futures, and other features. Companies entering this space — ranging from traditional brokerages to crypto-native firms — are vying for market share, potentially increasing Bitcoin’s liquidity and utility over time, VanEck says.

Bitcoin price volatility

Despite this, volatility remains a defining feature. While Bitcoin has doubled in value over the past two years and nearly tripled over three, the absence of extreme blow-off tops or drawdowns has tempered expectations. Future bitcoin moves may be more measured, with midterm investors likely to see smaller cyclical peaks and troughs rather than the dramatic swings of prior cycles.

VanEck said the broader market is in correction. Short- to medium-term speculative activity is retreating, long-term holders are holding steady, and institutional accumulation is rising. Coupled with signs of miner capitulation, subdued volatility, and macroeconomic dynamics, the firm frames the current environment as one of structural recalibration.

As 2025 draws to a close, Bitcoin may be in a period of consolidation that reflects broader market maturation, VanEck said. This may result in some strong positive price moves in the first quarter of next year.

This post Despite a Volatile December For Bitcoin, Bullish Signals Are Emerging: VanEck first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

SoftBank Reportedly Finalizes $40 Billion OpenAI Investment

Materials Sector Earnings Forecast to Rise 20% in 2026 Amid Steel Tariffs