FARTCOIN Sees $2.66M Whale Buying as $0.36 Comes Back Into Focus

This article was first published on The Bit Journal.

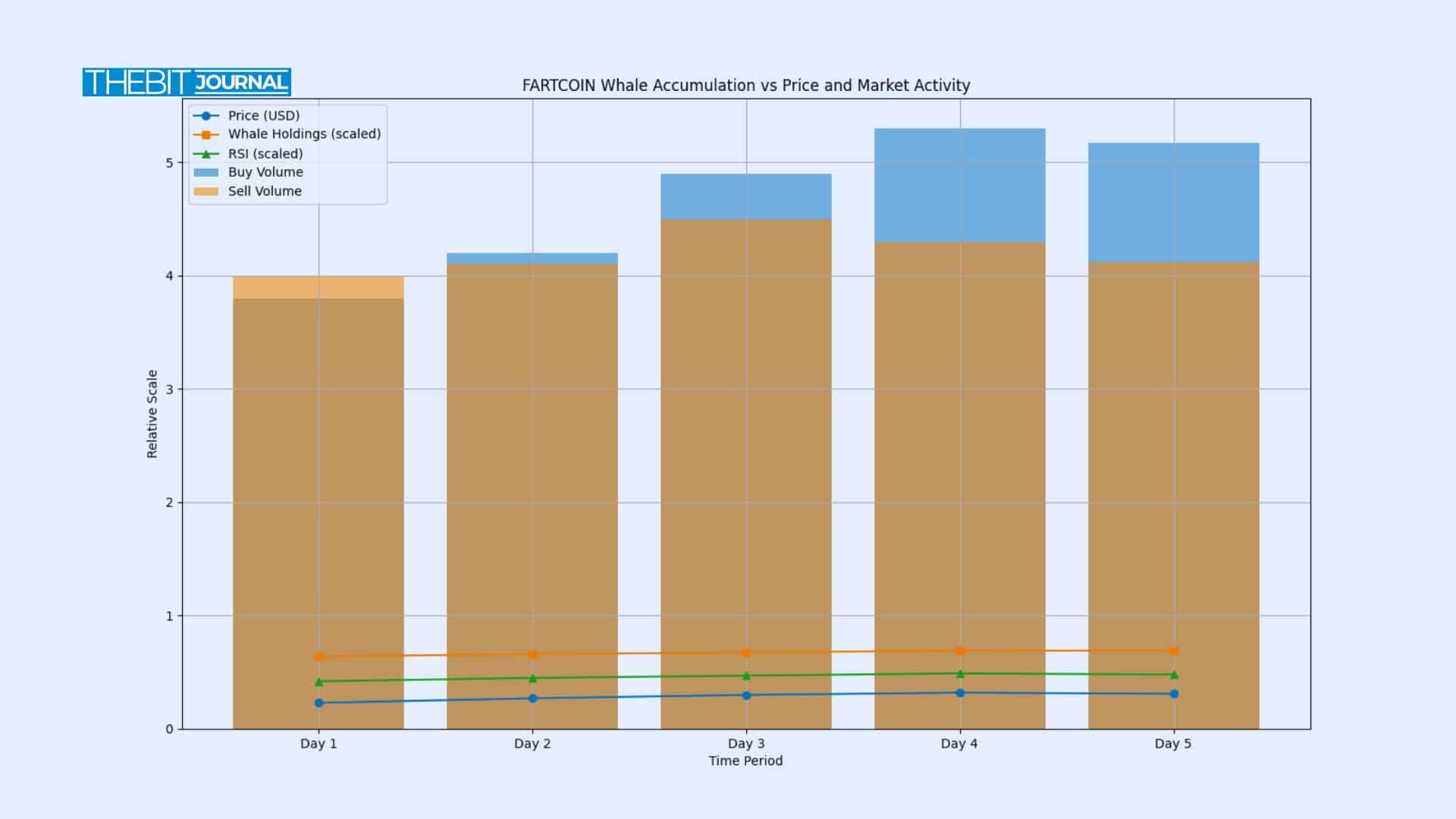

FARTCOIN whale accumulation has quietly become a notable development in the broader memecoin landscape, drawing attention as larger holders pick up tokens while prices trade sideways. At a time when technical pressure remains uneven, this pattern has sparked questions about whether big money sees value others are overlooking.

According to the source, recent on-chain data shows whales added significantly to their holdings even as price failed just above recent highs, challenging traders to interpret what comes next.

Across this noise, the memecoin has continued to chart a path marked by tension between accumulation and distribution. At time of writing, FARTCOIN is trading near psychological levels that could decide the next breakout or breakdown, making it essential to understand not only whale behavior but also technical context and market momentum.

Whale Buying During Weakness Suggests Strategic Positioning

A large wallet recently executed a $2.66 million purchase, acquiring roughly 8.58 million FARTCOIN tokens. This move is meaningful because it occurred during a period when price retraced from a local peak near $0.32 and settled around $0.31. According to blockchain monitoring, whales increased holdings by nearly 9.38% over a multi-day stretch, adding far more than they sold.

Historically, such accumulation during price weakening is a characteristic of investors with conviction. Instead of chasing momentum, these participants typically seek to absorb available supply quietly, setting the stage for a potential trend shift later on. When whales behave this way, it can signal early confidence in future price recovery.

Exchanges Show Buy Volume Outpacing Selling

Market data from centralized exchanges shows that recent buy volume outstripped sell volume, contributing to a positive market delta. Even without a decisive breakout, this dynamic points to rising demand at current price levels.

While everyday traders watch candlesticks and patterns, exchange liquidity flows are equally telling. Bid pressure accumulating despite technical hesitation suggests that some participants are prepared to buy dips rather than wait for spikes.

Whale Accumulation Rises As FARTCOIN Price Consolidates Near Resistance

Whale Accumulation Rises As FARTCOIN Price Consolidates Near Resistance

Technical Pressure Still Favors Sellers

Despite these accumulation signals, many technical indicators still favor seller control. Momentum tools like the Relative Strength Index have remained below neutral, and trend control indicators show sellers dominating for multiple weeks. This creates a situation where intelligent accumulation exists alongside broad hesitation, delaying a clean breakout.

Such behavior is not unusual in meme-driven assets. Retail traders often respond slowly to early signs of trend change, making the technical shift lag behind on-chain activity. For this reason, consolidation can appear dull even when big holders are quietly positioning.

Price Levels to Watch for Breakout or Breakdown

Analysts monitoring FARTCOIN note critical price levels that could define the next phase. A reclaim of $0.36, previously rejected, would signal renewed interest and a possible opening toward $0.40. Conversely, sustained selling could drive price lower toward $0.28, offering another entry zone for patient buyers.

These thresholds matter because they represent psychological and structural barriers. Crossing above them in either direction tends to bring new participants into the fold, increasing volume and volatility.

Conclusion

FARTCOIN whale accumulation reflects a fascinating interplay between smart money and broader market sentiment. Large buyers are showing conviction even as price stalls and technical indicators linger, illustrating how on-chain behavior can diverge from chart-based signals.

For students, analysts, and developers, this scenario highlights how early accumulation can precede broader momentum shifts. Whether price catches up remains uncertain, but the groundwork is clearly being laid for the memecoin’s next defining move.

Glossary of Key Terms

Whale Accumulation: Large holders increasing their positions over time.

Market Delta: Difference between buy and sell volume.

Relative Strength Index (RSI): A measure of buying vs. selling pressure.

Trend Break: A move past a key resistance or support level.

FAQs About FARTCOIN Whale Accumulation

What does FARTCOIN whale accumulation mean?

It suggests big holders expect future upside and are accumulating before price moves.

Is price guaranteed to rise after this activity?

No, accumulation does not always lead to higher prices without broader participation.

What key levels matter now for FARTCOIN?

The $0.36 resistance and $0.28 support are crucial battlegrounds.

Should traders follow whales?

Whale behavior can inform strategy but should be paired with technical and risk analysis.

Sources / References

Bitget

Binance

Read More: FARTCOIN Sees $2.66M Whale Buying as $0.36 Comes Back Into Focus">FARTCOIN Sees $2.66M Whale Buying as $0.36 Comes Back Into Focus

You May Also Like

Sources say SoftBank has fully committed to its $40 billion investment in OpenAI.

UAE’s Medcare Treats First International SMA Patient With Revolutionary Intrathecal Gene Therapy