Standard Chartered Lowers Bitcoin Forecast: Predicts Price Dive To $50,000 Before Rebound

Standard Chartered lowered its long-term outlook for Bitcoin (BTC) for the second time in less than three months as the cryptocurrency market appears to have entered a new bearish cycle.

With the leading cryptocurrency currently consolidating below the key $70,000 level, the bank now warns that the asset could fall as low as $50,000 before staging a recovery.

Standard Chartered Cuts Bitcoin Target to $100,000

In a note published Thursday, Geoff Kendrick, Standard Chartered’s head of digital assets research, said the bank now expects Bitcoin to reach $100,000 by the end of 2026.

The latest figure marks a significant reduction from its previous $150,000 projection for BTC. The revision follows an earlier downgrade in December, when the bank cut its target from an ambitious $300,000.

According to Bloomberg’s report on the matter, the bank’s more cautious stance reflects a combination of weakening macroeconomic conditions and shifting investor behavior, especially over the past month’s downtrend.

The leading cryptocurrency has declined more than 40% from its October peak toward current trading prices of around $67,160, while the US spot Bitcoin exchange‑traded funds (ETFs) sector has seen nearly $8 billion in net outflows.

Kendrick noted that slowing US economic momentum and reduced expectations for Federal Reserve (Fed) rate cuts have weighed heavily on digital assets. In particular, declining ETF holdings have removed what had been a critical source of demand during previous rallies.

The interest‑rate environment remains a central concern. Markets have pushed back expectations for Federal Reserve easing, with investors now anticipating that the first rate cut may come later in the year than previously thought.

Kendrick also pointed to uncertainty surrounding future Federal Reserve leadership as an additional factor contributing to Bitcoin caution. The bank warned that deteriorating macro conditions and the risk of further investor capitulation could continue to pressure prices in the near term.

Ethereum Could Drop To $1,400

Despite the more conservative Bitcoin forecasts, Standard Chartered emphasized that the current downturn appears more orderly than previous crypto market collapses.

Kendrick highlighted that on‑chain activity data continues to show improvement, suggesting that underlying network usage remains healthy.

Moreover, the bank’s head of research highlighted that the market has not experienced the type of high‑profile platform failures that defined the 2022 cycle, when the collapses of Terra/Luna and FTX triggered widespread contagion.

The bank also revised its outlook for Ethereum (ETH). Its 2026 price target for the second‑largest cryptocurrency was reduced to $4,000 from $7,500. Before reaching that level, analysts expect Ether could fall to around $1,400.

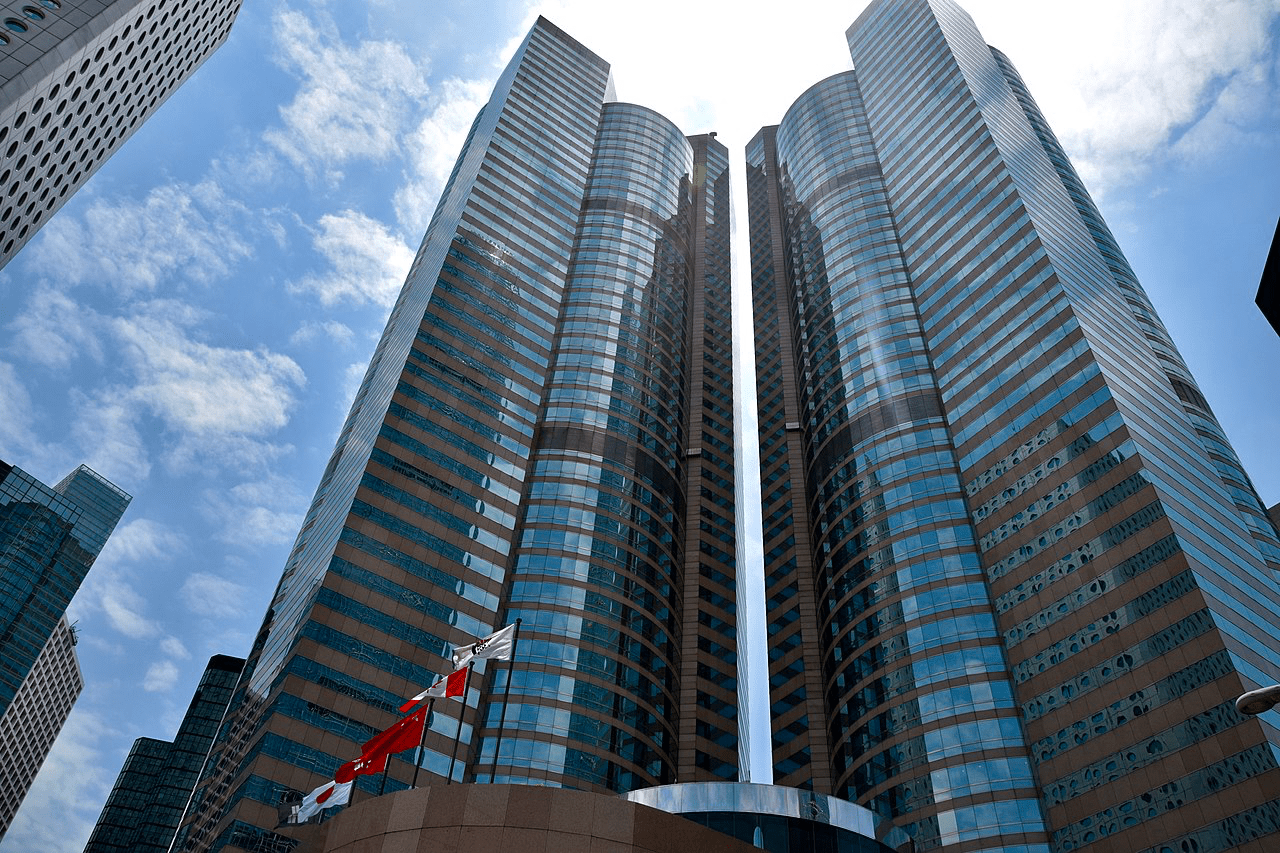

Featured image from OpenArt, chart from TradingView.com

You May Also Like

Spot ETH ETFs Losses Outpace Bitcoin As Monthly Netflows Remain Negative

The Hithium Disclosure Risk Highlights Regulatory Enforcement Challenges of the Stationary Battery Industry