Chainlink Accumulates 99,103 LINK as Reserve Strengthens Network Sustainability

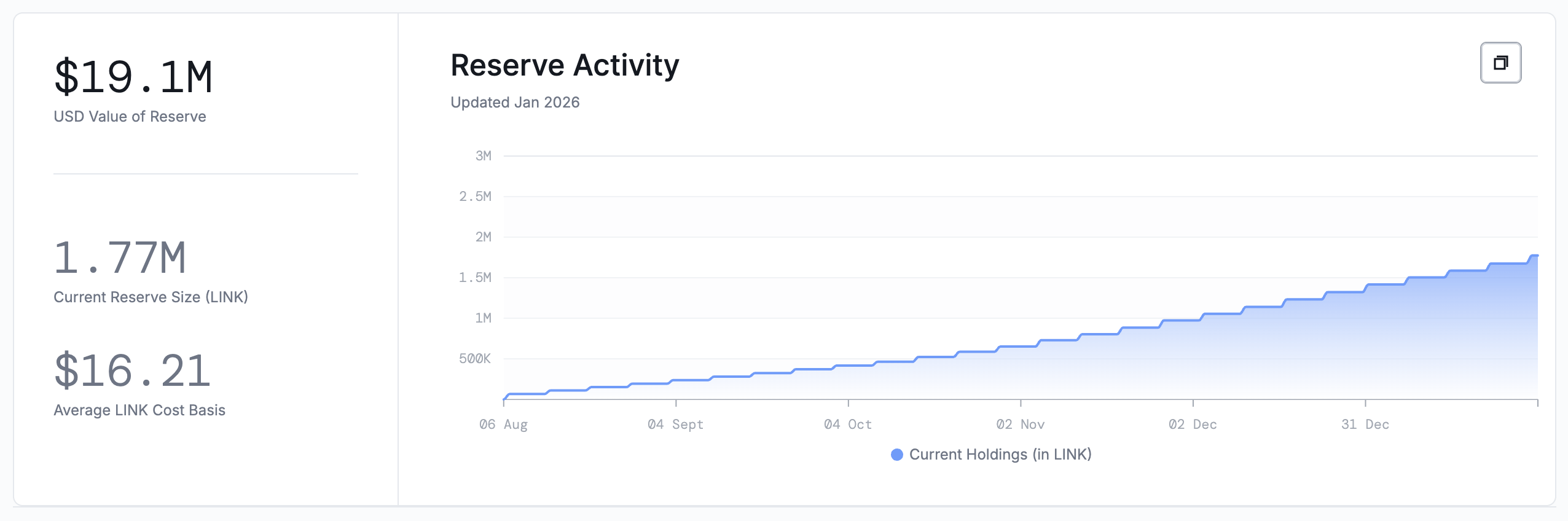

- Chainlink Labs has acquired nearly 100,000 LINK tokens for its reserve, bringing the total number of tokens to over 1.7 million.

- The company’s stash is now worth $19.1 million, but at an average LINK cost basis of $16.2, it has lost 34% of its investment.

Chainlink Labs has acquired nearly 100,000 LINK tokens for its reserve as it seeks to strengthen the network’s sustainability and create value for the token holders.

The company took to social media to reveal that it had accumulated 99,103 LINK, worth $1.054 million at the current prices. After the latest purchase, the reserve now holds 1,774,215.90 LINK, worth $18.877 million at press time.

The company stated:

The firm has been accumulating LINK tokens since launching the reserve in August last year. This month alone, it has made five purchases, with each adding to its position and reducing the circulating supply. On Jan 22, it purchased 88,000; on Jan 15, it bought 82,000; on Jan 8, it bought 87,000; and as we reported, it accumulated 94,000 tokens at the turn of the year.

Data shows that the company has accumulated the tokens at an average price of $16.21. With LINK trading at $10.7 at press time, the firm has lost over a third of its investment. However, the reserve is not aimed at turning a profit for the company, but at strengthening the entire network and giving a boost to the price by reducing the circulating supply, which currently stands at 708 million tokens. The maximum supply is one billion tokens.

Image courtesy of metrics.chain.link

Image courtesy of metrics.chain.link

The reserve launched last August, as we reported, to accumulate LINK using revenue gained from enterprises using the company’s technology in their onchain projects. It uses Payment Abstraction to convert both onchain and offchain revenue from any token to LINK. The company says that it has already generated hundreds of millions of dollars from enterprises that pay offchain to access its technology.

Chainlink Simplifies Advanced Smart Contracts

In a separate video, founder Sergey Nazarov broke down how the Chainlink Runtime Environment (CRE) has been simplifying advanced smart contracts. He lauded the Ethereum Virtual Machine (EVM), which he says opened the door to smart contracts. However, EVM smart contracts are limited to Ethereum.

Nazarov noted:

Additionally, all this needs to happen in an environment that enables a high level of privacy. This, says Nazarov, is what CRE does.

LINK trades at $10.7 at press time, shedding 7.6% in the past day despite a 130% surge in trading volume to hit $688 million.

]]>You May Also Like

Markets await Fed’s first 2025 cut, experts bet “this bull market is not even close to over”

Red Dress Collection Concert Launches American Heart Month with Star-Studded Awareness Effort