Bears vs. Bulls: Will the Bears Push Monero (XMR) Lower, or Is a Reversal Incoming?

- Monero is currently hovering around $428.

- XMR’s trading volume has declined by 19%.

With the dominant sentiment being bearish, which spreads fear in the market, the price movement of the crypto tokens has been charted in red. The momentum is being lost day by day despite recovering. Bitcoin (BTC), the largest asset, is hovering at $86.8K, while Ethereum (ETH), the largest altcoin, is at $2.9K.

Among the altcoins, Monero (XMR) has registered a 2% loss in the last 24 hours. As the asset chose to undergo downside pressure, it has fallen toward $425.20. Before the bearish shift, it was trading at a high range of $450.56. Upon the bears staying longer in the XMR market, the price would steadily decline.

The Coin Market Cap data has exhibited that at the time of writing, Monero trades within the $428.88 zone, with its market cap reaching $7.9 billion. Alongside, the daily trading volume of XMR has decreased by over 19.55%, staying at the $129.95 million mark.

Could Monero Face Further Downside Pressure?

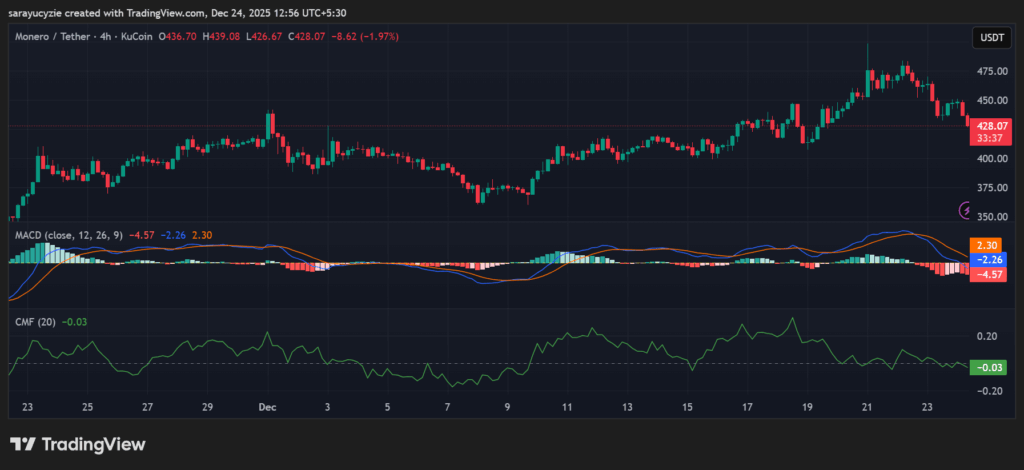

The MACD line of Monero is settled below the zero line, while the signal line is above the zero line, which points out weakening momentum. The broader trend remains bearish, but the short-term momentum shows signs of improvement. In addition, the CMF indicator is found at -0.03, which hints at mild selling pressure in the XMR market. Notably, the capital is flowing out of the asset, but it is weak.

XMR chart (Source: TradingView)

XMR chart (Source: TradingView)

With the active bearish pressure, the Monero price could retrace to the support range at $425.31. If the downside correction intensifies, the golden cross might unfold, and the bears would send the price below $422. Conversely, assuming a bullish reversal, the price might climb to the $431.50 resistance level. An extended gain could trigger the emergence of the golden cross, gradually pushing the Monero price up above $434.

Monero’s daily RSI is resting at around 38.80, indicating bearish sentiment, with the sellers in control, and the asset is not yet oversold. At this level, a potential short-term bounce may occur if buying interest emerges. Moreover, the BBP reading of XMR at -29.95 suggests very strong bearish pressure with the price trading below. The downtrend is likely to remain dominant unless the indicator moves back above zero.

Top Updated Crypto News

Solana (SOL) Bears Press On: Will It Hold Its Ground or Bounce Back?

You May Also Like

The Channel Factories We’ve Been Waiting For

What is the Outlook for Digital Assets in 2026?