Venture Capitalist: The World Is Going Internet-First—Here’s What You Need to Know

Modern economies in advanced nations are rapidly shifting towards a digital, internet-driven landscape dominated by technology giants and decentralized platforms, according to Balaji Srinivasan, former Coinbase executive and author of “The Network State.”

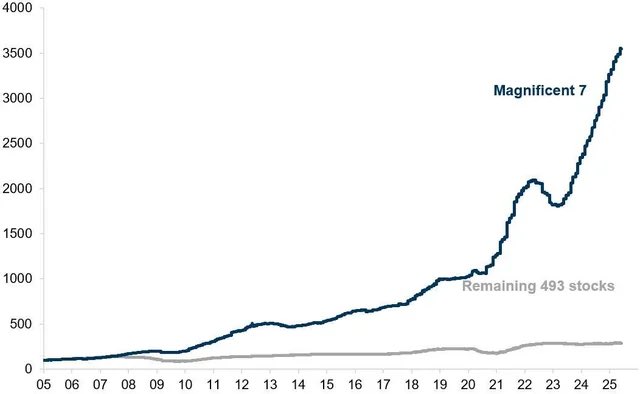

“The traditional economy is being sunset in favor of the Internet economy,” Srinivasan asserted in a recent post on X. He shared a compelling chart highlighting the stark divergence in stock performance: while the so-called “Magnificent Seven” tech stocks—comprising Apple, Microsoft, Amazon, Google’s parent company Alphabet, Meta Platforms, Nvidia, and Tesla—are experiencing exponential growth, the rest of the S&P 500 has seen relatively stagnant performance since 2005.

Magnificent Seven tech stock performance versus the remaining 493 companies in the S&P 500 index. Source: Balaji Srinivasan

Magnificent Seven tech stock performance versus the remaining 493 companies in the S&P 500 index. Source: Balaji Srinivasan

The S&P 500, a key gauge of U.S. economic health, tracks the performance of the top 500 companies by market capitalization. Srinivasan emphasized that since the 2008 financial crisis, our financial dealings—transactions and communications—have migrated online, foreshadowing a future where entire communities, cities, and even governments operate on internet-based platforms. “The world is becoming Internet-First,” he said.

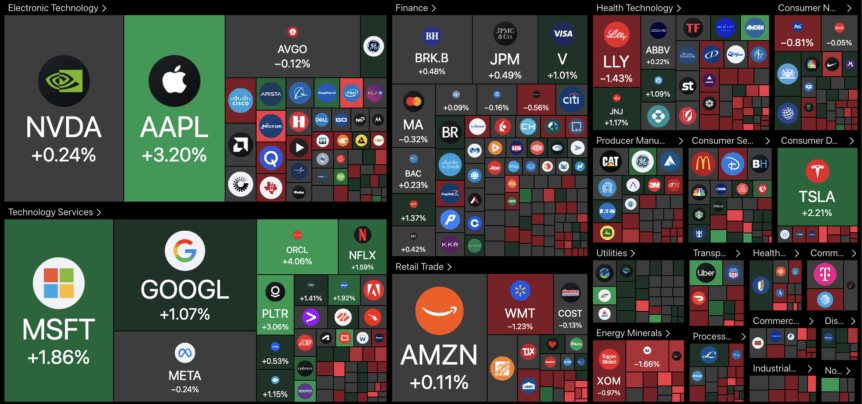

The legendary tech stocks within the Magnificent Seven include industry leaders: Apple and Microsoft, Amazon, Google, Meta Platforms, Nvidia, and Tesla. These giants exemplify how technology and internet companies are reshaping the landscape of the U.S. stock market, reflecting the broader trend of technology-driven wealth concentration.

Technology and internet stocks dominate the US stock market. Source: TradingView

Technology and internet stocks dominate the US stock market. Source: TradingView

Srinivasan has been a prominent voice in the discussion around “Network States”—distributed online communities he predicts will eventually replace traditional nation-states. These digital-constructed entities will rely on internet-native cryptocurrencies, marking a revolutionary shift comparable to the transition from agrarian societies to industrial economies during the Industrial Revolution.

As the crypto ecosystem matures, blockchain technology, decentralized finance (DeFi), and non-fungible tokens (NFTs) are increasingly integral to this transition, embodying a new form of digital sovereignty and economic independence.

Disruption of Legacy Systems by Blockchain and AI

Conventional financial systems and government agencies have historically been slow to adopt innovative technologies. Nonetheless, U.S. regulators are now actively exploring the integration of blockchain and artificial intelligence (AI) to modernize markets.

The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) issued a joint statement in September, proposing a transition to 24/7 capital markets—facilitating round-the-clock trading aligned with the global crypto markets. Additionally, the government has engaged oracle providers such as Pyth Network and Chainlink to publish economic data on-chain, aiming to enhance transparency and accountability.

This push toward digital infrastructure signifies a broader paradigm shift where blockchain and AI technologies are poised to reshape finance and governance, fostering a more dynamic, transparent, and interconnected financial landscape.

This article was originally published as Venture Capitalist: The World Is Going Internet-First—Here’s What You Need to Know on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Crypto Shows Mixed Reaction To Rate Cuts and Powell’s Speech

Hedera (HBAR) Price Today, Chart & Market Cap | Live HBAR to USD Converter