Dismantling Hyperliquid's top whales' trading codes and gaming strategies: the art of leverage and timing

Author: Frank, PANews

As the market conditions pick up, the whale operations on Hyperliquid have once again attracted market attention.

These mysterious big investors, known as "whales", have created ripples on the platform with their strong financial strength, unique trading strategies and accurate grasp of the market pulse. Their every move is not only a magnifying glass of market sentiment, but also provides us with a window to observe how top traders play the game.

Analyzing their different trading methods, risk preferences and logic of success and failure. Here, PANews attempts to uncover a corner of their wealth code and explore what experiences and lessons ordinary investors can learn from them.

Short-term sniper @qwatio: The event-driven and high-leverage art of "50x Brother"

This trader is an industry OG who has been posting Bitcoin-related content on Twitter since 2014, and his content style seems to be that of a loyal Bitcoin fan. For unknown reasons, @qwatio chose to disappear from social media in 2015. Until March 2025, due to the high-leverage short-selling of Bitcoin with a profit of more than $9 million, which triggered heated discussions on social media, on-chain investigator ZachXBT said that the source of his funds was related to hackers, and @qwatio chose to disclose his identity to respond to doubts.

@qwatio's trading style is characterized by high risk and high return. He often uses 50x leverage and has a keen ability to capture the market. For example, around the Fed's interest rate decision on March 20, 2025, he first shorted BTC at $84,566, and closed the position after the price fell to $82,000, making a profit of $81,500. He then went long at $82,200 and closed the position when the price rebounded to $85,000, making an additional profit of $921,000, a total of 164% profit. He is therefore called "Hyperliquid 50X Brother" on social media.

From his trading strategy, @qwatio is good at capturing event-driven and short-term opportunities, and also shows a unique market vision. The famous battle mentioned above is to use the expectation of the Federal Reserve's interest rate decision to infer that there will be short-term opportunities in the market and repeatedly operate, making huge profits in the band. At the same time, he can also decisively start when the market is extremely panic. When Ethereum fell to around 1500, the market was bearish on Ethereum. @qwatio chose to spend 5.5 million US dollars to buy 3715 Ethereum (average price 1493.5), and sold it at 2502 US dollars, making a profit of 3.74 million US dollars.

On May 12, the results of the Sino-US trade negotiations were announced, and the market will foresee a wave of volatility. @qwatio chose to short Bitcoin at $104,094 and subsequently made a profit of $1.18 million.

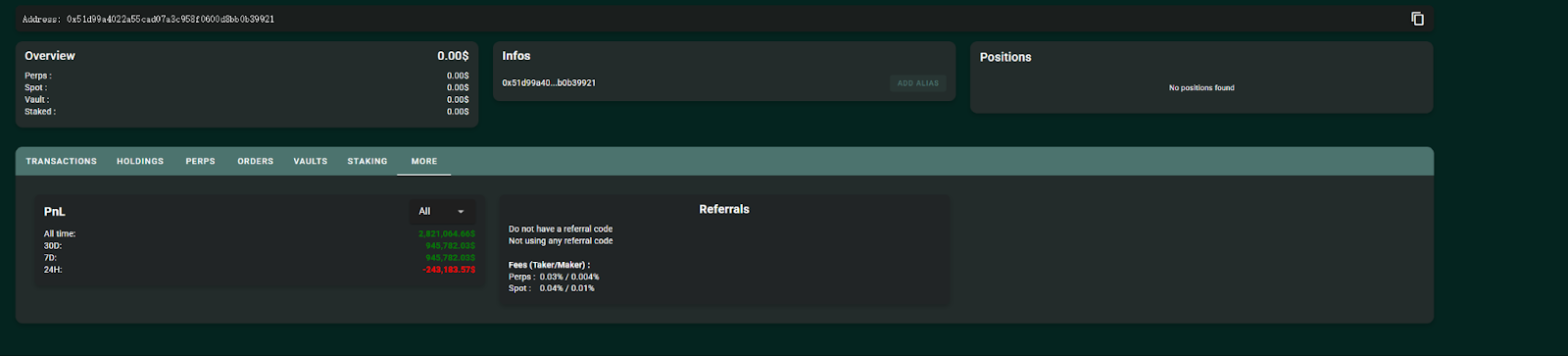

As of May 13, @qwatio had made a profit of about $2.82 million on Hyperliquid. In summary, @qwatio's operations were not frequent, and he only performed 3 to 4 operations in 2 months. However, each operation was able to accurately predict a short-term trend, and he was bold and skilled, and his position was only a stone's throw away. However, this style is not suitable for ordinary users to imitate, and he often left the market with losses in several operations of copycat tokens.

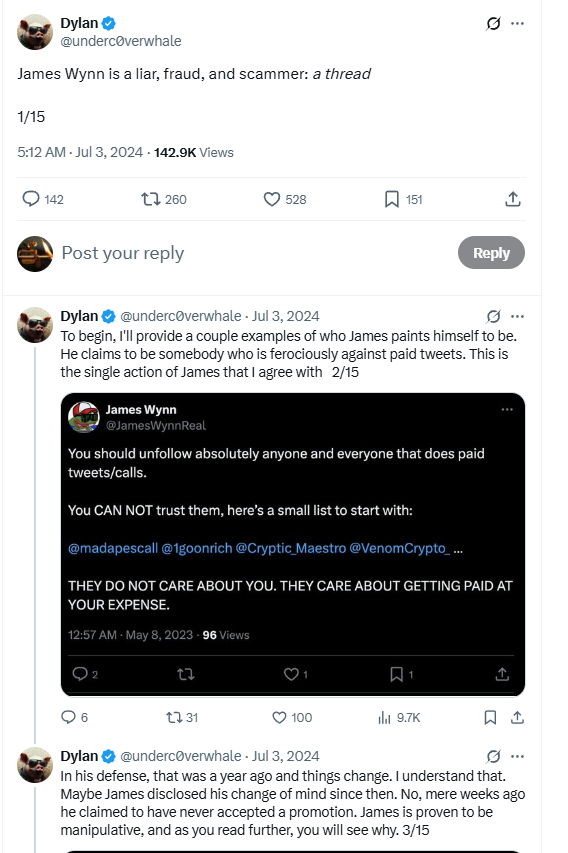

Legend and controversy coexist: James Wynn's MEME coin hunting and big money operations

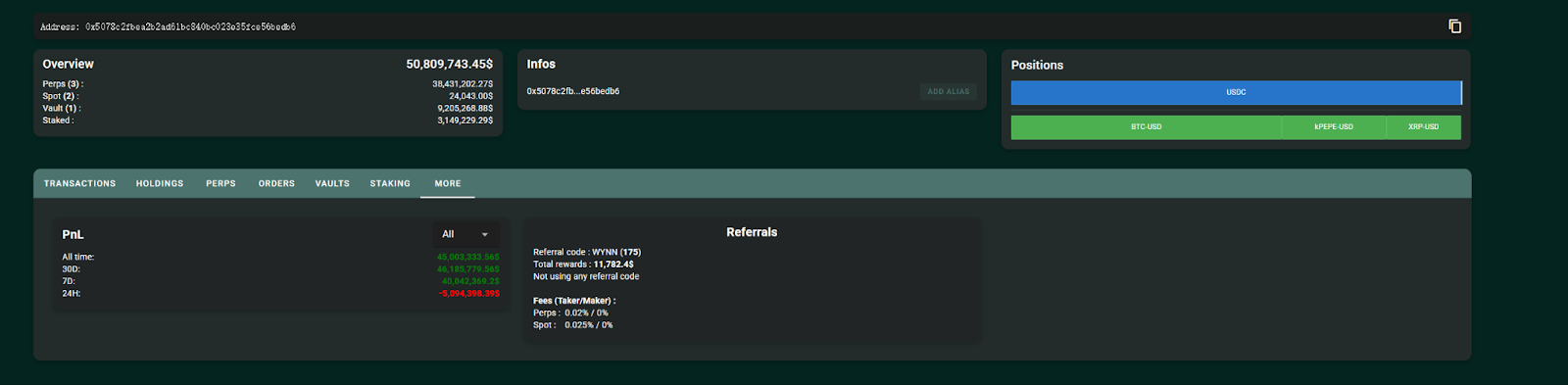

James Wynn has been active in Hyperliquid since March 2025. In terms of operation style, James Wynn prefers a relatively large cycle (several days), and in addition to mainstream tokens, James Wynn also prefers to bet on MEME-themed tokens such as TRUMP, Fartcoin, and PEPE. The high volatility of MEME tokens seems to have become the main source of his profit.

Judging from the positions still held on May 13, the unclosed profit brought to him by PEPE long orders reached 23 million US dollars, far exceeding the profits of other mainstream tokens such as BTC.

However, in terms of the use of leverage, James Wynn is obviously more conservative. He seems to like to set different leverage multiples for different volatility. For example, BTC’s opening position is set with 40 times leverage, while PEPE only has 10 times leverage.

In addition, James Wynn also set up the largest user vault on Hyperliquid (Moon Capital), but unlike his personal precision operations, the current position of this vault is not ideal. Opening a long BTC position at the price of 103,533, the yield of this position was about a loss of 10% as of May 13. The loss was about $960,000. In the past month, the overall yield of this vault was -8%. Even so, it still attracted $10 million in deposits, but $9.2 million of which were James Wynn's own.

Overall, James Wynn's earnings from Hyperliquid reached $45 million. His trading strategy mainly focuses on long positions to capture the market's uptrend. For example, he opened a 40x long position when the BTC price was $94,000, and when the price rose to more than $100,000, the floating profit reached $5.4 million. Although his trading win rate is not high (about 47%), he can still make huge profits through large positions and high leverage.

James Wynn is known as a "legendary trader" in the community, but his trading success is also accompanied by certain controversies. Some community members accused him of taking advantage of the trust of the community to make profits, such as by promoting Meme coins to drive up prices and then sell them off, such as the Baby Pepe pump-and-dump incident in 2024. However, he responded to this as nonsense. As of now, these controversies and responses are in an unverified state.

Overall, James Wynn's successful trading also benefits from his large positions, with each position opening tens of millions or even hundreds of millions. Coupled with his keen insight into market changes, his high returns have been achieved. Sufficient margin also allows his liquidation price insurance to reach a high threshold. This style can help him achieve a higher winning rate, but if the trend is misjudged, he will also suffer a greater loss.

The mysterious whale that has just emerged: mainstream coins testing the waters and swinging under low leverage

This mysterious whale is another big player that often appears in news flashes. However, this whale has only been active on Hyperliquid in recent days. The initial reason for attracting attention was that it spent more than $8 million to go long on ETH. Since then, the address has made a profit of more than $8.16 million in a week by going long on XRP and SOL.

From the perspective of operation style, this giant whale also has the characteristic of strong financial strength, with the initial opening funds reaching 36 million US dollars. In addition, this mysterious giant whale is not keen on short-term operations in the form of extreme speculation, but chooses low leverage and prolongs the holding time to maintain profits.

From the perspective of the choice of trading products, this whale has only traded three mainstream altcoins, ETH, XRP, and SOL. Among them, ETH made a profit, but XRP and SOL suffered losses in the end. From the perspective of trading strategy, this whale does not seem to be decisive enough. At the beginning, he only opened a position in ETH, and then chose to open long positions in XRP and SOL at high levels during the market surge. As a result, as the market pulled back, the whale may have also experienced psychological fluctuations. Therefore, all orders were closed. Although the final result was a profit, from the perspective of operating style and thinking, it is not worth learning.

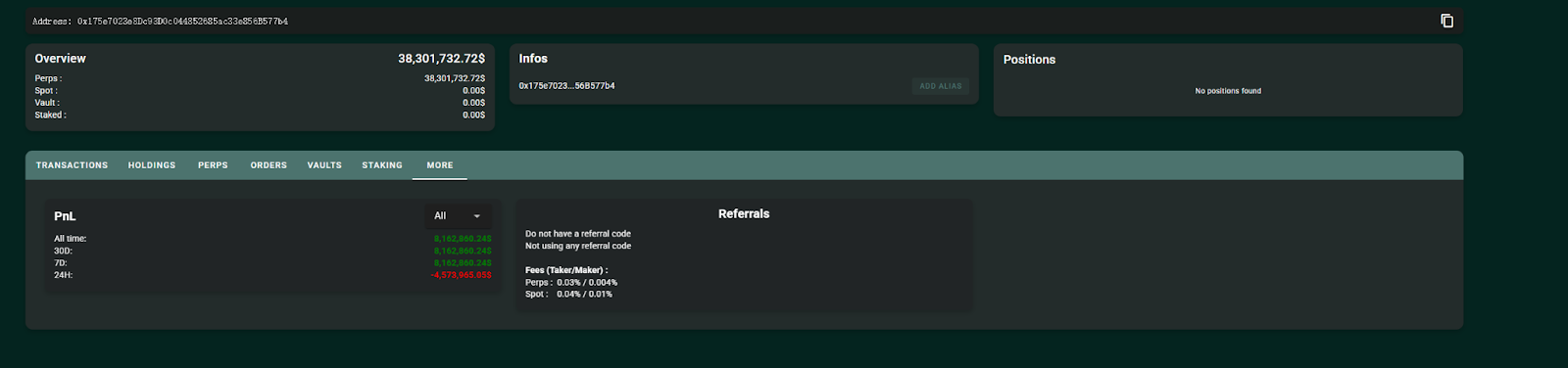

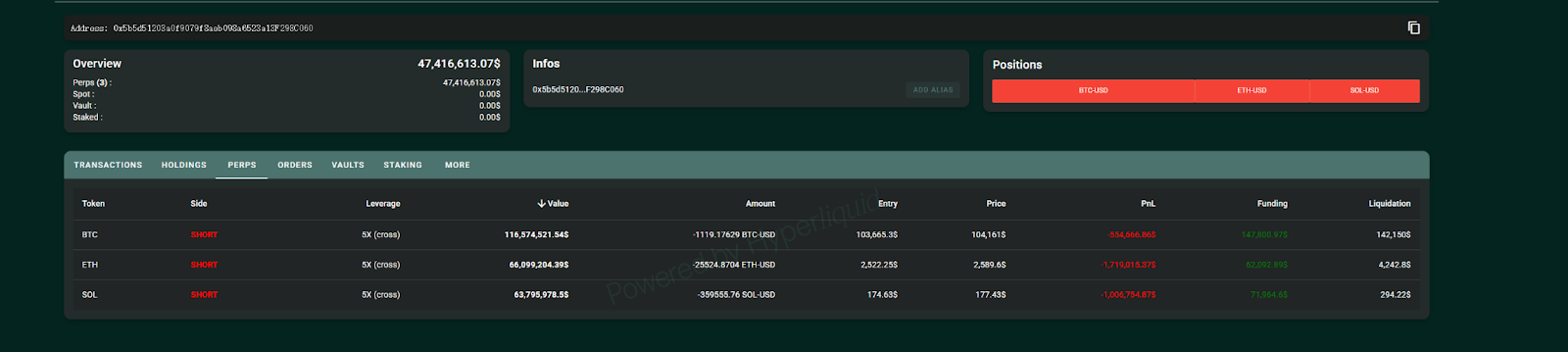

The market's staunch contrarians: Can the bearish whales who spend big bucks have the last laugh?

Compared with the whale mentioned above, this whale can be regarded as a temporary negative example. Data as of May 13 showed that this address had a floating loss of 3.12 million US dollars by shorting BTC, ETH, and SOL.

Since May 10, this whale has been injecting $50.5 million into Hyperliquid for short selling. The total amount of holdings exceeds $230 million. Among them, the amount of holdings in BTC exceeds $110 million. This whale seems to be a firm bear in the market, with all the $50.5 million funds invested in positions, and has not closed the positions for several days.

However, due to the strong margin, the liquidation price of this address is difficult to reach (BTC liquidation price is $142,000, Ethereum liquidation price is $4,254, SOL liquidation price is $294). In terms of the profit and loss of the overall position, the current loss is only about 6%.

Of course, we cannot conclude whether the final direction of this whale is right or wrong. We can only continue to observe in the future to see whether this mysterious market contrarian is a prophet who predicts the market in advance or acts out of spite of his wealth.

Looking at these "powerful" whales on Hyperliquid, it is not difficult to find that their trading routines are different, and there is no "holy grail" that applies to all. However, in general, whales are generally accustomed to choosing BTC, ETH, SOL, XRP and other tokens with higher liquidity as their operating objects. In terms of trading style, everyone has their own set of habits. Some people are keen on high leverage, and some people are used to predicting the market in advance. But the positions and investments of these whales are obviously like to take risks on the tip of a knife, which is not desirable and cannot be replicated for ordinary investors. After all, in the crypto ocean full of rapids, only by continuous learning and forming your own trading system can you sail steadily in the stormy waves.

You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm