Crypto market rebounds as Trump-Xi meeting leads to easing trade tensions

- Donald Trump’s meeting with Xi Jinping in South Korea led to a reduction in trade barriers.

- Bitcoin, Ethereum, and XRP edge up by nearly 1% on Thursday, recovering early losses.

- The cryptocurrency market recorded over $800 million in total liquidations in the last 24 hours.

The cryptocurrency market recovers gradually during the early European session on Thursday after US President Donald Trump’s meeting with Chinese President Xi Jinping in South Korea regarding trade barriers. Despite the positive meetup, liquidations in the crypto market exceeded $800 million over the last 24 hours, as Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) recoup earlier losses.

Crypto market recovers after Trump, Xi smoothing out rough corners

US President Donald Trump and Chinese President Xi Jinping concluded the high-stakes trade meeting on an optimistic note in South Korea on Thursday, as previously reported by FXStreet. The key decisions made public from the meeting are that China will resume rare-earth exports with a one-year contract, purchase US soybeans, and discuss chips with NVIDIA, while the US has reduced tariffs to 47% from 57% and has fentanyl tariffs. The world’s two largest economies are smoothing rough corners, which could stabilize global financial markets and help cryptocurrencies extend their recovery.

Earlier in the day, the cryptocurrency market had previously extended losses following hawkish remarks from Federal Reserve (Fed) Chair Jerome Powell on Wednesday: "A further reduction in the policy rate at the December meeting is not a foregone conclusion, far from it," stated Powell after the Fed reduced the federal fund rates by 25 basis points to the 3.75%-4% range. Powell suggested that the lack of clarity in economic data, due to the US government shutdown entering its fourth week, could dissuade the agency from further rate cuts.

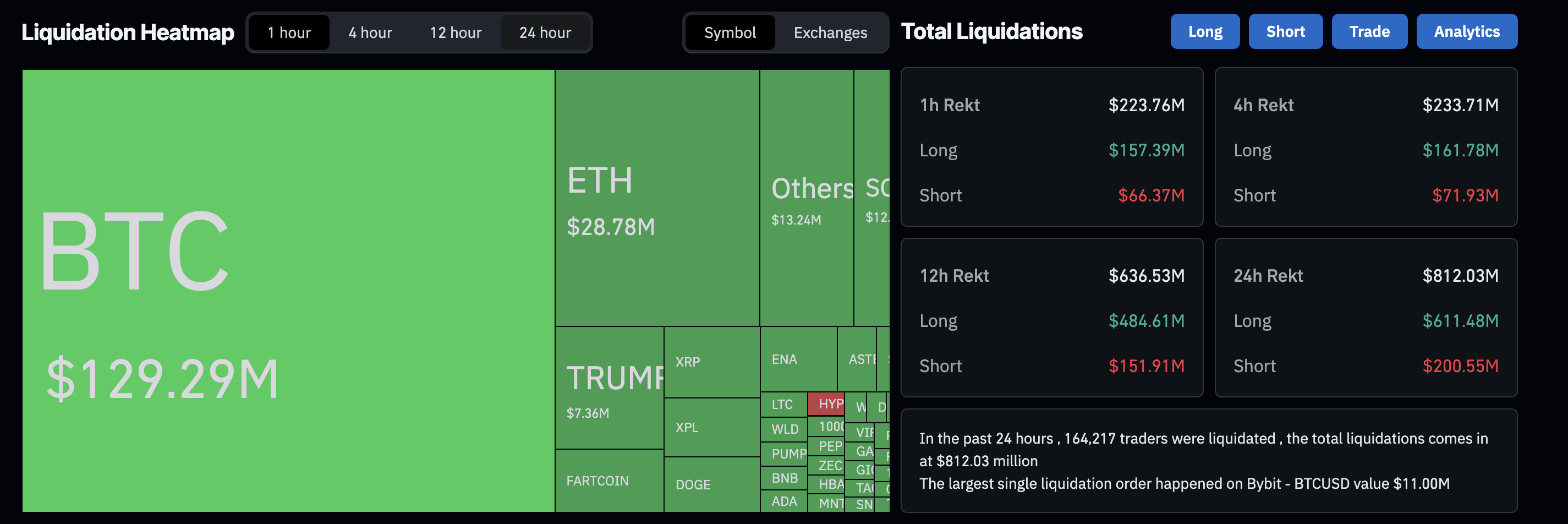

The recent volatility has led to major liquidations in the cryptocurrency market. CoinGlass data shows that $812.03 million in positions were liquidated in the last 24 hours, with $611.48 million in long positions and $200.55 million in shorts.

More recently, the total liquidations have reached $223.76 million in the last hour after the Trump-Xi meeting, with long liquidations of $157.39 million outpacing short liquidations of $66.37 million.

Crypto market liquidations data. Source: CoinGlass

The total cryptocurrency market capitalization stands at $3.73 trillion, up by 1% at press time on Thursday as Bitcoin, Ethereum, and XRP trade above $110,000, $3,900, and $2.55, respectively, and gradually recover from Wednesday's losses.

(This story was updated on October 30 at 07:55 GMT to reflect the latest price action.)

You May Also Like

Crypto-Fueled Rekt Drinks Sells 1 Millionth Can Amid MoonPay Collab

Solana Price Prediction from Standard Chartered