WLFI plans to launch institutional-level stablecoin USD1: first launched on Ethereum and BNB Chain, with policy dividends and Trump's brand effect as support

Author: Nancy, PANews

The stablecoin market is experiencing explosive growth, with market capitalization rising rapidly and more and more new players rushing into the market. Recently, the Trump family's crypto project WLFI announced plans to launch USD1, a US dollar stablecoin suitable for institutions. This move not only demonstrates the Trump family's ambition in the crypto field, but is also seen as a key step for them to comply with regulatory trends and seize the market by leveraging brand effects.

First launch of Ethereum and BNB Chain, institutional market becomes the main target

WLFI's intention to get involved in stablecoins has already been revealed.

As early as October last year, former Paxos CEO Rich Teo announced that he would join WLFI as head of stablecoin and payment business. Paxos has issued multiple stablecoins, including the stablecoin BUSD launched in cooperation with Binance, but affected by the regulatory turmoil, the market value of the stablecoin has fallen from a peak of 24 billion US dollars to only 50 million US dollars at present. Shortly after Rich joined, Decrypt quoted sources as saying that WLFI plans to issue its own stablecoin, which is still in the development stage and may take some time to launch.

In mid-March, Bloomberg reported that WLFI had discussed cooperation with Binance. People familiar with the matter revealed that the discussions between the two sides included the possible joint development of a dollar-backed stablecoin. According to four people familiar with the matter, it is unclear at what stage the negotiations have progressed, and it is uncertain whether any deal or cooperation will be reached.

Recently, market rumors have finally settled, and WLFI officially confirmed that USD1 will be launched soon. According to the official introduction, USD1 is a stablecoin that can be exchanged for US dollars at a 1:1 ratio, and will be 100% backed by short-term US government bonds, US dollar deposits and other cash equivalents. In the initial launch, USD1 will be minted on the Ethereum and BNB Chain blockchains, and plans to expand to other protocols in the future. Its reserve assets are held by BitGo, one of the largest digital asset custodians in the United States, and are regularly audited by a third-party accounting firm.

Different from algorithmic stablecoins or anonymous DeFi projects, USD1 combines the flexibility of DeFi and relies on the credibility and security of traditional finance, avoiding high-risk return promises. Unlike other US dollar stablecoins that are more oriented to retail users, USD1 is mainly aimed at institutional clients, positioning itself to provide safe and efficient cross-border payment and trading tools, while supporting the widespread application of the DeFi ecosystem. However, USD1's target users do not seem to be retail investors. Zach Witkoff, co-founder of WLFI, emphasized that "USD1 is a digital US dollar stablecoin tailored for sovereign investors and large institutions, which can seamlessly and securely support cross-border transactions."

The block browser shows that the smart contract for USD1 was deployed three weeks ago, with a total supply of about 3.5 million and only six token holders, including the market maker Wintermute address, which has made some test transfers.

Binance founder CZ also welcomed the deployment of USD1 recently, saying that USD1 does not need to replace USDT and USDC, and the more stablecoins the better. He also reminded that many scammers have created currencies with the same name, but trading is not yet open, so please do not be fooled.

The competition for stablecoins is fierce. What are the competitive advantages of USD1?

The stablecoin market is expanding at an astonishing rate, and its position in the global financial market is becoming increasingly prominent.

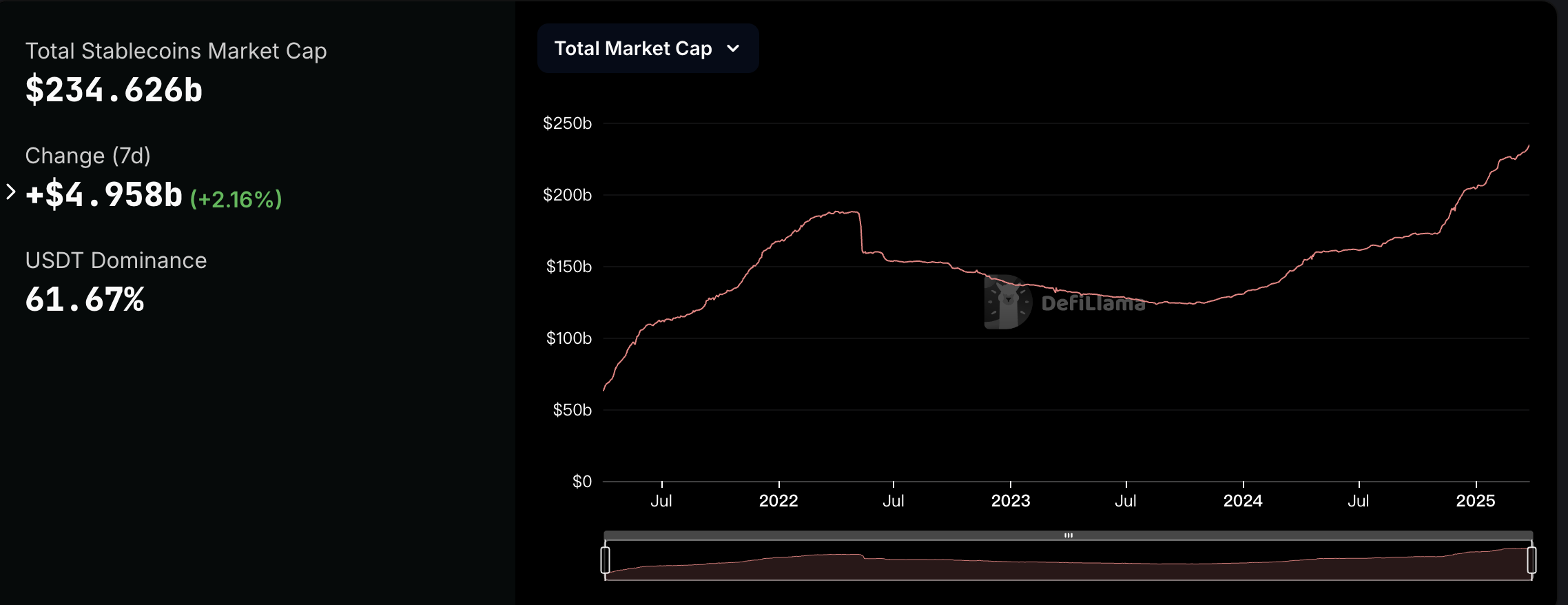

According to DeFillama data, as of March 26, the total market value of stablecoins exceeded US$234.62 billion, a record high, up 65.3% year-on-year. Among them, USDT and USDC dominate the market, accounting for nearly 87.3% of the market share. ARK Invest even predicts that the size of the stablecoin market may even exceed one trillion US dollars in the long run. Matt Hougan, chief investment officer of Bitwise, further pointed out that once stablecoins reach this size, the overall pattern of the crypto market will be reshaped.

At the same time, according to the stablecoin report previously released by Dune and Artemis, as of February 2025, the supply of stablecoins has reached 214 billion US dollars, the active addresses have reached 30 million, and the annual transfer volume has reached 35 trillion US dollars, which is twice the annual throughput of Visa. It is worth noting that the report also pointed out that although centralized exchanges are still the main place for stablecoin liquidity, DeFi drives most of the transfer volume.

The rapid development of stablecoins is inseparable from the increasingly improved global regulatory framework, including the United States, the European Union, Japan, and Singapore.

The United States and Japan have made significant progress in the regulatory compliance of stablecoins, which provides greater space for the innovation and promotion of compliant stablecoins. For example, USDC recently became the first stablecoin officially approved for use in Japan, and Thai regulators identified USDT as a legal cryptocurrency. At the same time, market competition is becoming increasingly fierce, and new players are accelerating their entry. For example, Fidelity is reported to be planning to launch a stablecoin, World Network under OpenAI CEO Sam Altman is negotiating with Visa for stablecoin payment wallet cooperation, and crypto payment giant MoonPay has acquired the stablecoin company Iron at a high price.

Despite this, USD1 still has significant competitive advantages. On the one hand, the new trend of stablecoin regulation in the United States may clear the way for compliant dollar stablecoins, including US President Trump's recent emphasis that the return of the dollar to stablecoins will help expand the dollar's dominance, and called on Congress to pass landmark legislation to establish simple, common-sense rules for stablecoins and market structures.

It is understood that there are currently a number of stablecoin bills being intensively promoted in the United States, including the STABLE Act, the GENIUS Act and Waters. These proposals aim to provide a clear regulatory framework for payment stablecoins pegged to the US dollar, promote innovation and protect consumers, and thus promote the global competitiveness of the digital dollar. Among them, the GENIUS Act is particularly eye-catching. The bill was jointly initiated by the two parties in the United States in February 2025. It clearly proposes to establish a federal regulatory framework to exclude payment stablecoins from the scope of securities and is not subject to SEC (Securities and Exchange Commission) supervision. Issuers will be subject to federal or state supervision according to their size. At the same time, the bill explicitly prohibits algorithmic stablecoins to reduce systemic risks. The GENIUS Act has been supported by both parties and promoted by the White House. It was recently passed by the Senate with 18 votes in favor and 6 votes against, becoming the most likely proposal to be signed into law in mid-2025. According to Bo Hines, executive director of the US President's Digital Asset Task Force, the US stablecoin regulatory bill may be submitted to President Trump for signature within two months.

On the other hand, Trump's brand effect will also bring strong financial and resource support to WLFI. In terms of funds, WLFI has obtained up to US$550 million through community public offerings, of which US$390 million is net income. In terms of resources, stablecoins play a vital role in the DeFi ecosystem, and WLFI has established deep connections with leading DeFi projects through diversified investments, including Aave, Uniswap, Ethena, Chainlink, Ondo Finance and other leading projects.

Overall, with the rapid expansion of the global stablecoin market and the increasing maturity of the regulatory framework, the launch of USD1 is a strategically significant layout for WLFI. It has also built a unique competitive advantage by relying on policy dividends, institutional differentiated positioning and Trump's brand influence.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates