BitMine Approaches 4M ETH Holdings as Tom Lee Cites Market Stability

Ethereum’s largest corporate treasury holder, BitMine Immersion, announced another major Ethereum ETH $2 955 24h volatility: 4.1% Market cap: $357.17 B Vol. 24h: $28.58 B purchase, lifting total holdings to 3.97 million tokens. The latest acquisition, valued at roughly $320 million, reinforces the firm’s strategy of accumulating Ethereum during periods of market consolidation rather than chasing short-term price momentum.

BitMine Expands Ethereum Treasury as Holdings Approach Four Million ETH

BitMine said it holds Ethereum as a long-term strategic asset and an inflation hedge, not as a trading position. The company reported total crypto and cash holdings of approximately $13.3 billion, underscoring the scale of its balance sheet exposure to digital assets. Ethereum remains the dominant allocation, alongside a small Bitcoin BTC $85 761 24h volatility: 3.4% Market cap: $1.71 T Vol. 24h: $44.56 B position and cash reserves.

In an official press release on Monday, Chairman Thomas Lee described current market conditions as stable enough to justify continued accumulation. He pointed to subdued volatility and improving regulatory clarity as factors supporting the firm’s conviction. BitMine’s acquisition strategy has remained consistent, relying on large-volume purchases executed during price pullbacks rather than incremental buying.

The most recent purchase follows an aggressive buying streak earlier in December 2025. Over the week ending December 15, BitMine added more than 102,000 ETH, building on a $435 million purchase completed the previous week. These transactions pushed the company within reach of the four million ETH milestone.

Despite the scale of its holdings, BitMine acknowledged it is currently sitting on roughly $3 billion in unrealized losses, as much of the ETH was acquired at higher valuations. Management maintained that short-term drawdowns do not alter its long-term outlook. Lee reiterated his belief that Ethereum’s expanding role in global finance could drive prices significantly higher over the next year.

BitMine Nears 4 Million ETH Accumulation in Five Months

BitMine began accumulating Ethereum in June 2025, shortly after regulatory conditions shifted in favor of corporate crypto exposure. Approval of US Bitcoin and Ethereum ETFs in 2024 opened the door for public companies to hold digital assets directly on balance sheets.

However, the implementation of new fair-value accounting standards for crypto assets and pro-crypto shift in the US regulatory stance pushed corporate demand for direct crypto exposure into second gear in Q2 2025.

Between June and August 2025, BitMine built its initial position, surpassing 1.297 million ETH by August 16. The pace intensified through September and October, with holdings crossing three million ETH by October 13. Accumulation continued into November, exceeding 3.5 million ETH by November 10.

In the week ending December 7, BitMine purchased 138,452 ETH, worth about $435 million. One week later, the firm added another 102,259 ETH, valued near $320 million.

As of December 15, BitMine holds 3,967,210 ETH, representing more than 3.2% of Ethereum’s circulating supply. The firm further extends its lead as Ethereum’s largest publicly-listed investor with Sharplink’s 859,853 ETH holdings in distant second place. Lee remains publicly optimistic, forecasting Ethereum could reach $7,000 by early 2026 despite current unrealized losses.

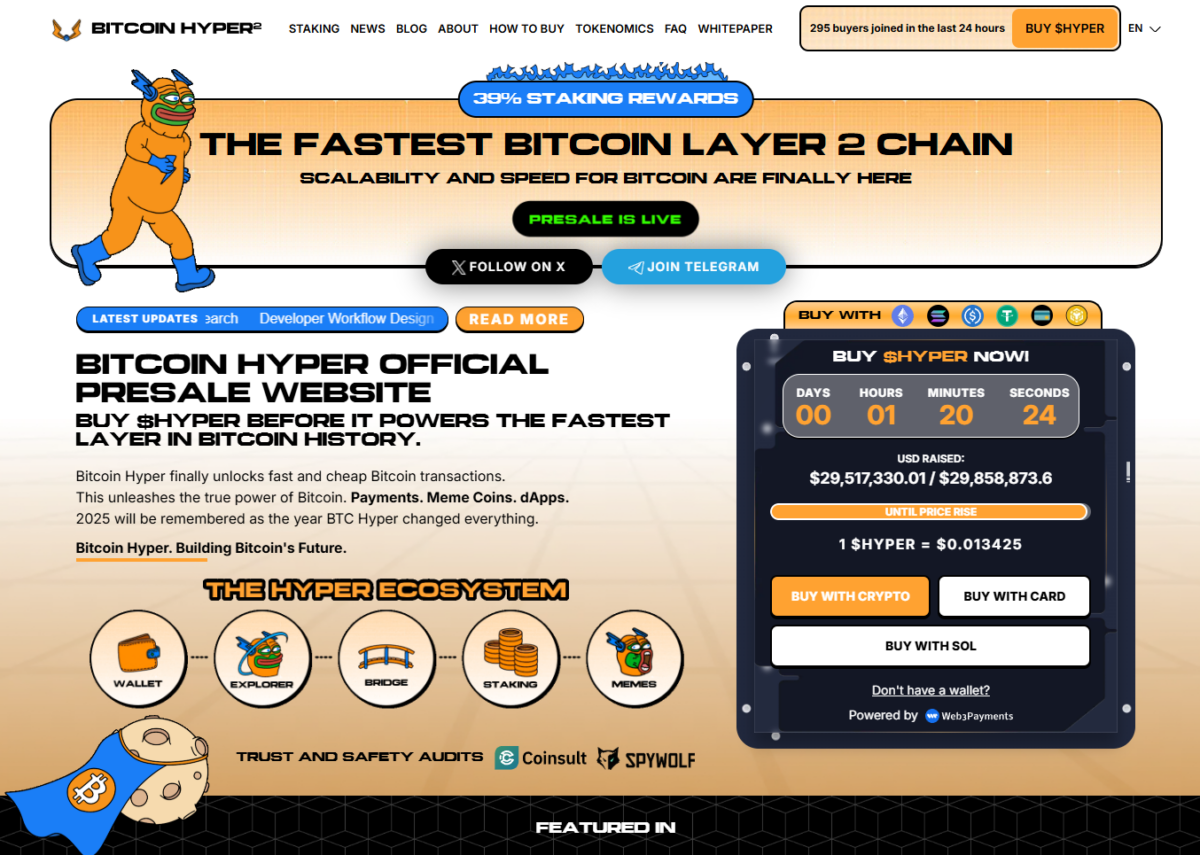

Bitcoin Hyper Presale Nears $30 Million as BitMine Adds $320M in ETH

Riding on fresh liquidity and positive sentiment around BitMine’s large ETH investment, early stage projects like Bitcoin Hyper are drawing attention.

In addition to staking rewards up to 39%, Bitcoin Hyper (HYPER) promises lightning-fast and low-cost transactions aimed at expanding Bitcoin’s use cases for payments, meme coins, and dApps.

Bitcoin Hyper Presale

HYPER has raised over $28.9 million, with its presale price currently set at $0.013235 per token. Prospective investors can visit Bitcoin Hyper’s official presale website to get in early before the next price tier unlocks.

nextThe post BitMine Approaches 4M ETH Holdings as Tom Lee Cites Market Stability appeared first on Coinspeaker.

You May Also Like

SOL Treasury Company Forward Industries: Market Turmoil Offers Opportunity to Consolidate Other Treasury Companies

PayPal and Coinbase currently the most oversold stocks on Wall Street