Solana Hit By One Of The Largest DDoS Attacks In Internet History

Solana has been battling what some ecosystem builders are calling an internet-scale DDoS campaign — and, despite the usual “Solana is fragile” jokes, the network seems to be shrugging it off.

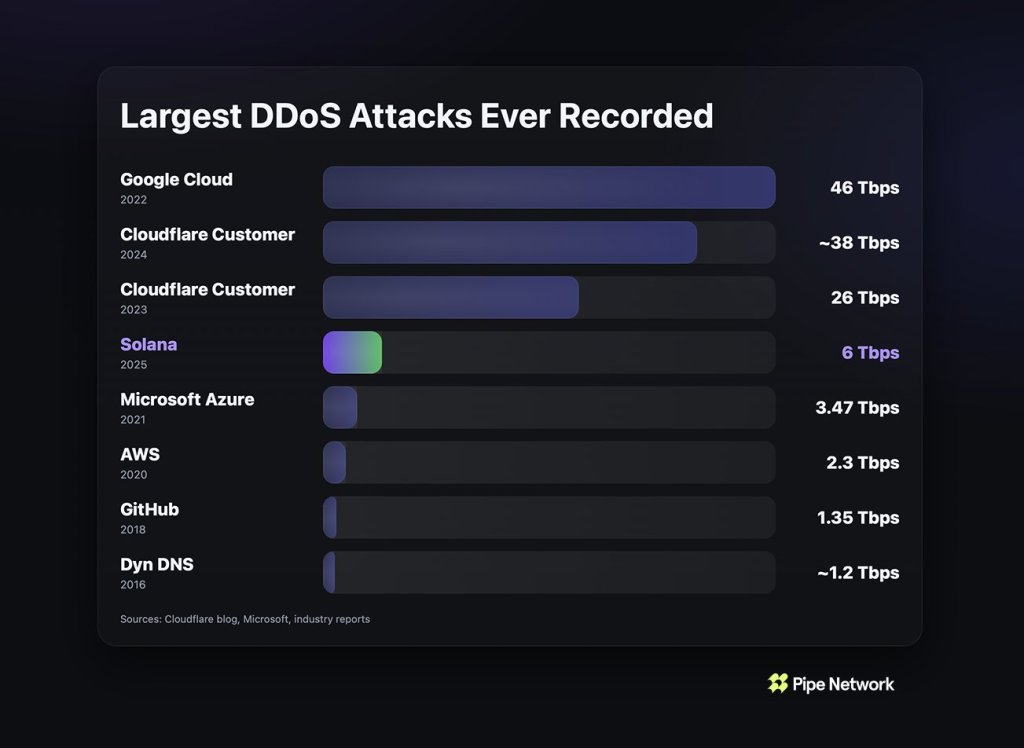

Pipe Network said of the ongoing attack via X today: “The ongoing DDoS attack on Solana is one of the largest in internet history. 6 Tbps volumetric attack translates to billions of packets per second. Under that kind of load, you’d normally expect rising latency, missed slots, or confirmation delays.”

Pipe further says that’s not what the data is showing. “Median tx confirmation ~450ms,” the team wrote, adding that p90 remains under 700ms and slot latency is holding at 0–1 slots. In other words, if you’re a regular user or trader, you might not even know anything’s happening. Which is kind of the point.

Reactions From The Solana Community

Raj Gokal, Solana Labs’ co-founder and COO, put it more bluntly in a reply to a broader DDoS debate: “have you heard about the ongoing DDOS against Solana that has had zero effect on performance?”

The backdrop here matters. Justin Bons had posted about Sui being DDoS’d yesterday, claiming it triggered “mass delays” and arguing that “127 validators is not enough,” with the broader warning: don’t let validator counts drift too low if you want a chain to be resilient.

Mert Mumtaz, CEO of Helius, largely agreed with the premise — but pushed back on the simplistic “more validators = solved” framing.

“I understand your point & mostly agree with you,” Mert wrote, before adding that “a chain is more resistant to DDoS with 100 professional high powered validators compared to 10k validators run by amateurs.” He also said there are scenarios where higher validator count can help, but emphasized it isn’t the core defense by itself. Then he dropped the key detail: Solana’s attack hasn’t been a one-day headline, it’s been going on for a while.

“And fyi there has been a colossal ddos attack on Solana for weeks now,” Mert wrote, later adding that Solana “has been under a colossal DDoS attack for at least over a week now btw” — and that the fact most users haven’t felt it is “a big testament to the level of engineering present here.”

Solana co-founder Anatoly Yakovenko chimed in with a more technical angle on why validator count can matter in specific leader-hand-off dynamics: “Validators count helps if the previous leader can finish their block while the current one is being hit. Then the cost of ddos approaches the cost of ddos the whole network.”

Translation: if an attacker wants to reliably disrupt block production, they may have to sustain pressure across more of the network, not just pick off a single leader at the wrong moment. That gets expensive fast.

SolanaFloor summed it up via X: “Solana has been under a sustained DDoS attack for the past week, peaking near 6 Tbps, the 4th largest attack ever recorded for any distributed system. Network data shows no impact, with sub second confirmations and stable slot latency. The Sui network was also targeted by a DDoS attack yesterday, resulting in delays in block production and periods of degraded network performance.”

And there’s a more strategic takeaway that’s starting to sound less theoretical each month: blockchains are now juicy targets. David Rhodus, founder of Permissionless Labs (and a contributor to Pipe Network), said: “This puts Solana among the most heavily DDoSed targets in internet history. It reinforces that blockchains are now Tier-1 DDoS targets. This is not “script kiddie” activity — 6 Tbps is industrial-scale.”

If you’re a validator, Mumtaz offered the practical advice you’d expect in a week like this: have backups across multiple hosting providers and regions. Because even if the chain holds, your own infrastructure might not.

The broader point, though, is the new baseline: these networks are getting stress-tested like mainstream internet services now. Solana’s claim today is that it passed — quietly, under load, and without users noticing. That’s the kind of victory that doesn’t look dramatic on a chart. It just […] works.

At press time, Solana traded at $126.

You May Also Like

Kalshi Jumps to 62% Market Share While Polymarket Eyes $10B Valuation

Visa Expands USDC Stablecoin Settlement For US Banks