Exploring PerpAI: What are the potential use cases for Perps + AI?

Author: Stacy Muur , Crypto KOL

Compiled by: Felix, PANews

You’ve surely noticed this: many DeFi protocols now incorporate AI agents:

Many DeFi protocols are now integrating AI Agents:

- Riding the Trading Trend

- Provide users with new automated and AI-driven experiences

This evolution has given rise to the new DeFAI movement (DeFi + AI). However, these discussions often overlook a key factor: perpetual DEX. So what happens when AI Agents meet Perps? How to take advantage of PerpAI?

PerpAI : Potential Use Cases

AI Agents are poised to revolutionize how we interact with everything, including cryptocurrencies. Here are some potential new use cases that could emerge at the intersection of perpetual trading and AI Agents.

We are already seeing use cases for AI Agents, such as from Spectral trading on Hyperliquid. But what use cases can perpetual DEX integrate into their platform?

1. Large-scale perpetual DEX in cooperation with aixbt

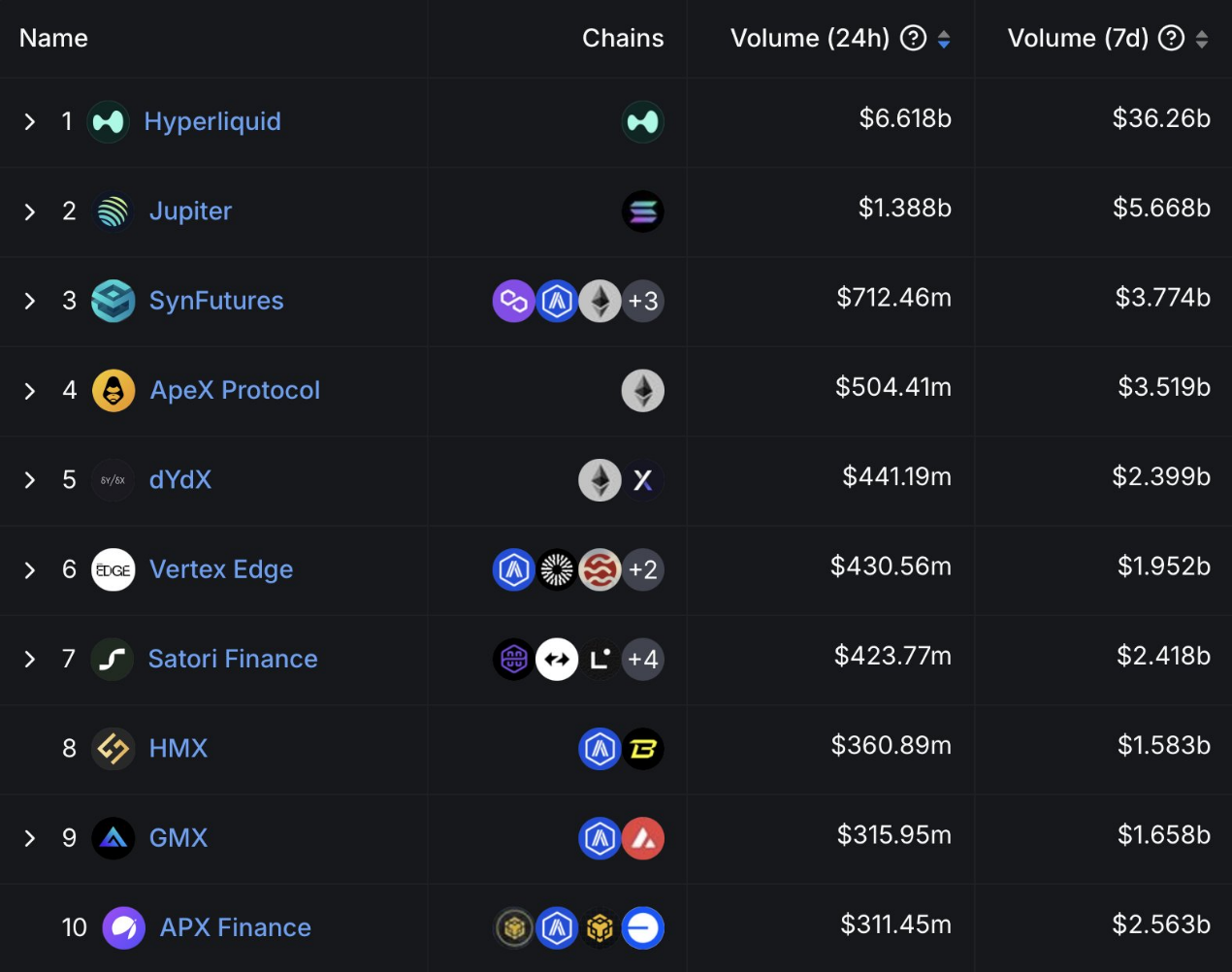

Currently, platforms such as SynFutures, Hyperliquid, Jupiter or dYdX are dominating perpetual contract trading. SynFutures, as the leading perpetual DEX on Base, may have a strategic advantage because aixbt is also based on Base.

Imagine a "Degen model" that uses insights from aixbt to automatically trade on SynFutures or another perpetual DEX. This model can integrate not only social analysis and news, but also native data such as open interest (OI), volume trends, and funding rates.

Example extension: Imagine a scenario where AI identifies a sudden spike in the funding rate of BTC perpetual contracts due to an increase in long positions. It can initiate a counter-trend short trade to maximize profitability from over-leveraged counterparty traders.

Access to these features may be granted via dual staking or dual token ownership (just guessing as teams tend to innovate in their own way).

2. AI Agents Manage Liquidation Risk

This use case could be a killer feature for early adopting DEXs. By monitoring funding rates, volatility, and collateral health, AI Agents can automatically adjust leverage levels to manage liquidation risk.

Example extension: Assume that the user's collateral is mainly ETH, and the market experiences a sharp drop in ETH prices. AI Agents can dynamically rebalance collateral to stablecoins to reduce liquidation risk, or even partially close positions when margin is too low.

In a more advanced setup, it can be hedged using options if there is a perpetual platform that supports this integration. This approach can give traders peace of mind knowing their positions are protected in real time.

3. AI Agents as Personal Trading Mentors

If you’ve ever played online chess, you’ve probably come across post-game analyses that highlight missed opportunities and mistakes. AI Agents can provide a similar experience for traders.

Example extension: Imagine a scenario where AI Agents generate a comprehensive post-trade report detailing areas for improvement, such as “You exited this trade too early; historical data shows that holding it for another hour would have increased profits by 15%.” It can also suggest alternative strategies based on historical success rates, such as “Consider using a trailing stop on trend-following trades.”

This concept opens up new revenue streams for experienced traders: allowing AI Agents to analyze their trades and understand the factors that influence entry and exit levels. Over time, the AI becomes smarter, able to identify common patterns of successful traders and provide guidance to less experienced users.

This service could be offered as a paid feature, providing a revenue share to traders with the highest ROI, or it could evolve into an automated AI-driven trader that learns from the best traders and mimics high-confidence trades based on their framework.

4. Liquidity AI Cluster

The idea is to focus on the other side of trading: liquidity. AI Agents can analyze factors such as volatility, market depth, and trading activity to create a kind of “swarm intelligence” that dynamically rebalances liquidity across markets and platforms.

Example extension: Imagine a scenario where there is a liquidity crunch in the market due to increased demand for a particular asset. The AI cluster can detect this in advance and reallocate liquidity from markets with lower demand to stabilize spreads and minimize slippage for traders.

In practice, this means that all perpetual DEXs have a unified liquidity pool, and AI Agents direct liquidity to high-demand markets. This approach can significantly improve capital efficiency and generate above-average returns for LPs by strategically allocating resources.

Key players to watch

Who might be the first teams to implement these ideas before they become the new gold standard for perpetual DEXs?

I am optimistic about on-chain DEXs that have high demand and adoption of AI Agents, such as Jupiter and SynFutures. Of course, the newly emerging Hyperliquid cannot be ignored.

The integration of AI Agents with DeFi, especially perpetual DEX, is more than just an incremental improvement, it represents a true paradigm shift. By leveraging AI tools, traders can unlock smarter, safer, and more efficient ways to navigate the market. At the same time, platforms that adopt these innovations early can position themselves as pioneers of the DeFAI movement.

Related reading: AI Agent track rebounds strongly, here are 10 emerging AI Agent projects that have attracted much attention

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates