AAVE Price Forecast: Bears take control as technical and on-chain signals warn of double-digit drop

- Aave price retests its previously broken ascending trendline, signaling a potential downside move.

- On-chain and derivatives data turn bearish, with Spot Taker CVD in negative territory and short positions hitting a one-month high.

- The technical outlook suggests weakness in momentum indicators, pointing to the likelihood of a double-digit correction in the near term.

Aave (AAVE) is facing renewed selling pressure as bearish momentum builds, with the price retesting a previously broken ascending trendline. On-chain and derivatives data further support the bearish thesis as AAVE’s Spot Taker Cumulative Volume Delta (CVD) is in negative territory, and short positions are hitting a one-month high. The technical analysis further reinforces the bearish outlook, suggesting that the AAVE token could be on the verge of a double-digit correction in the near term.

Aave’s on-chain and derivatives data show a bearish bias

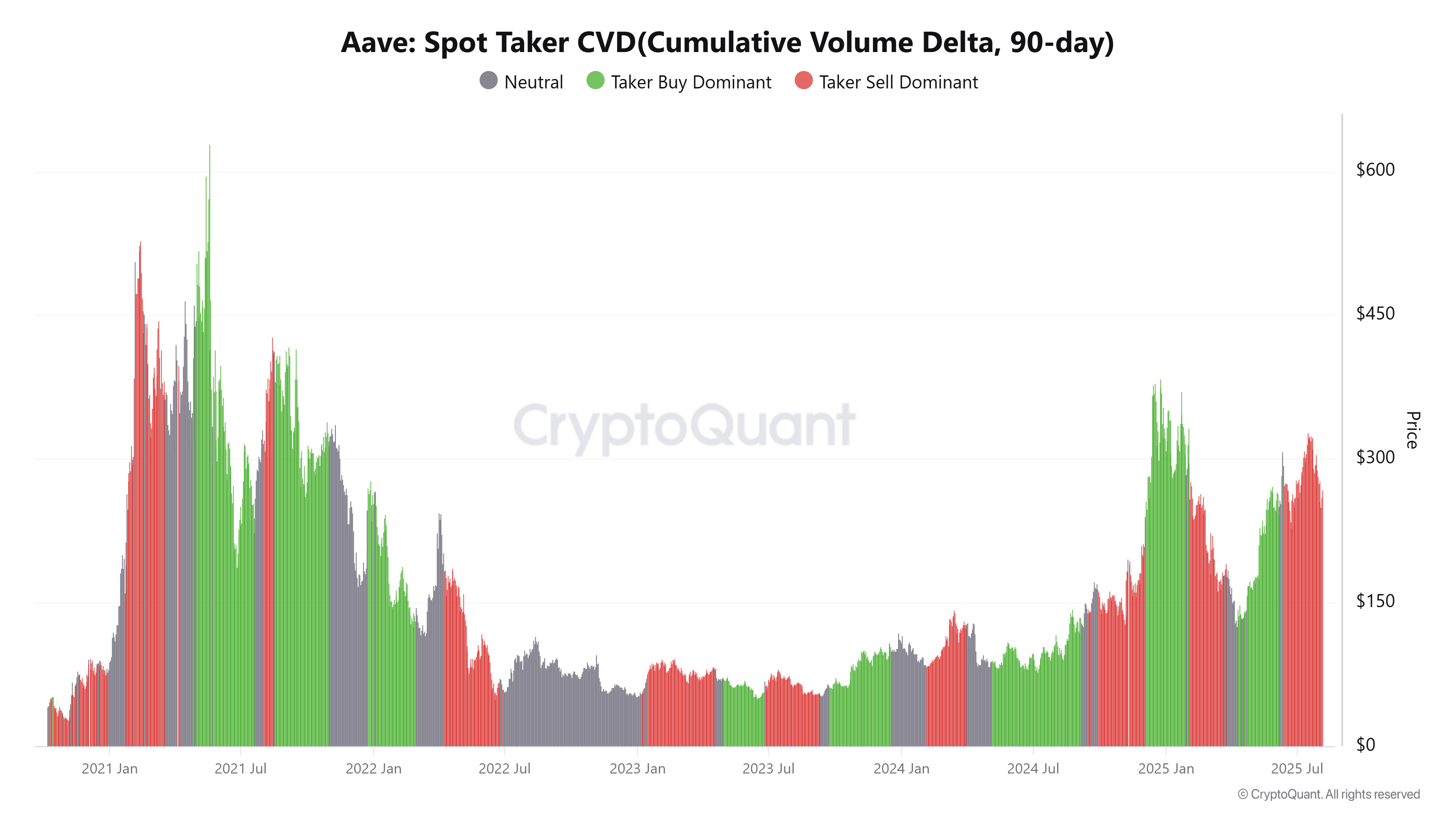

CryptoQuant data, as shown in the graph below, highlights selling pressure on Aave. The Taker CVD (Cumulative Volume Delta) for AAVE is negative, and the value has been steadily decreasing since mid-July. This indicator measures the cumulative difference between market buy and sell volumes over three months. When the 90-day CVD is positive and increasing, it suggests the Taker Buy Dominant Phase, while a negative and decreasing value indicates the Taker Sell Dominant Phase.

Aave Spot Taker CVD chart. Source: CryptoQuant

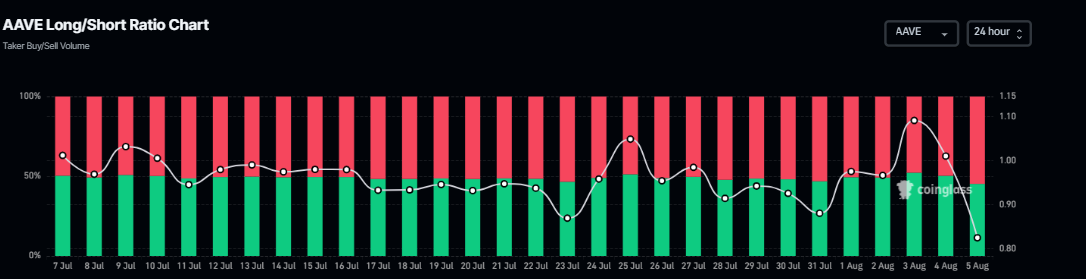

According to Coinglass’s data, the long-to-short ratio of Aave reads 0.82 on Tuesday, the lowest value in over a month. This ratio, below one, reflects bearish sentiment in the markets, as more traders are betting on the asset price to fall.

AAVE long-to-short ratio chart. Source: Coinglass

Aave Price Forecast: AAVE bears remain in control

Aave price broke below the ascending trendline (drawn by connecting multiple lows since early April) on Thursday and declined 5% in the next two days. However, it found support around its 200-day Exponential Moving Average (EMA) at $242.27 on Sunday and recovered 8.68% by Monday, retesting the previously broken ascending trendline. At the time of writing on Tuesday, it trades slightly down at around $262.13.

If AAVE continues its correction, it could extend the decline to retest its 200-day EMA at $242.27. A successful close below this level could extend an additional decline toward its 50% price retracement level at $225.64.

The Relative Strength Index (RSI) reads 40, below its neutral level of 50, indicating bearish momentum. Additionally, the Moving Average Convergence Divergence (MACD) also showed a bearish crossover that still holds, suggesting bearish momentum and a downward trend.

AAVE/USDT daily chart

However, if AAVE recovers and closes above its daily resistance level at $282.84, it could extend the rally toward its July 18 high of $349.23.

You May Also Like

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth

BetFury is at SBC Summit Lisbon 2025: Affiliate Growth in Focus