A complete analysis of my stablecoin income strategy with a monthly income of $500,000 and an average annualized return of 78%.

Author: Octoshi.eth

Compiled by Tim, PANews

By participating in points events and investing in real income agreements, I was making about $500,000 a month, which sounds crazy.

The following article will explain the sources of income.

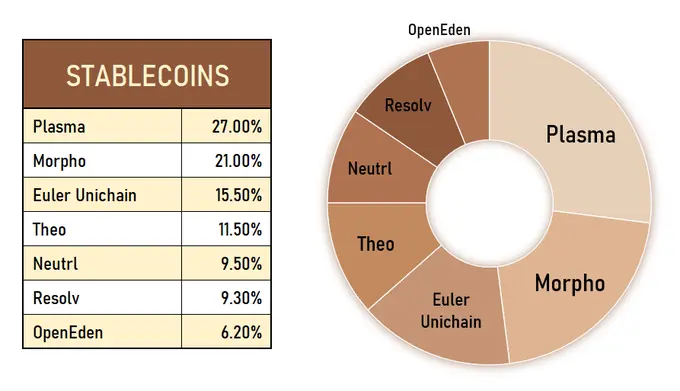

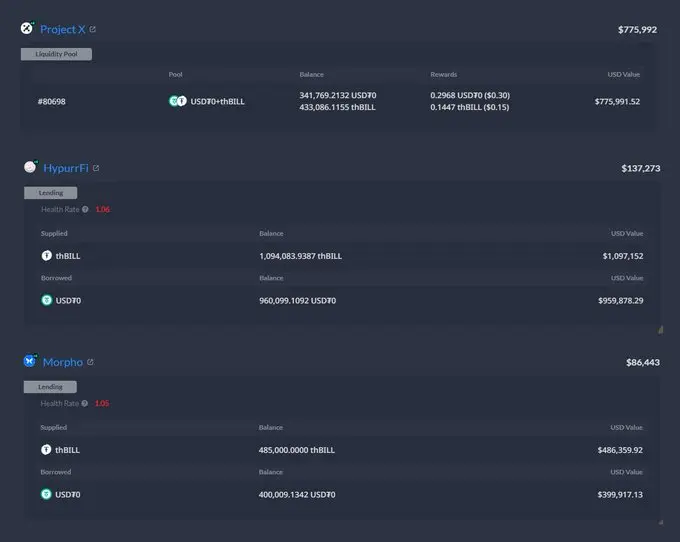

This is my current allocation, and my average annualized rate of return is 78%. While my estimate is conservative, a large portion of it is based on activity points, which makes it highly predictive.

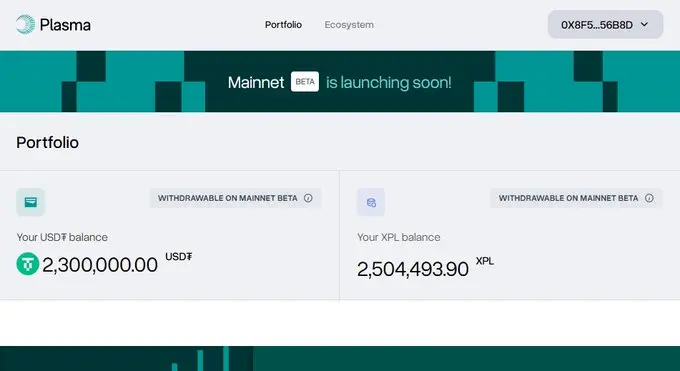

The first source of income was participating in Plasma. I deposited $2.3 million and bought $125,000 worth of XPL tokens at $500 million FDV.

Taking into account a 90-day investment cycle and the current $5.7 billion valuation on Hyperliquid, my annualized return is 217%. XLP is aiming for $10 billion!

The second source of income is a passive position that provides immediate liquidity so that I can jump in at any time when I find new income opportunities or interesting trades.

The operation is simple: I just need to deposit money into the Morpho fund, which currently earns an annualized rate of return of 10%.

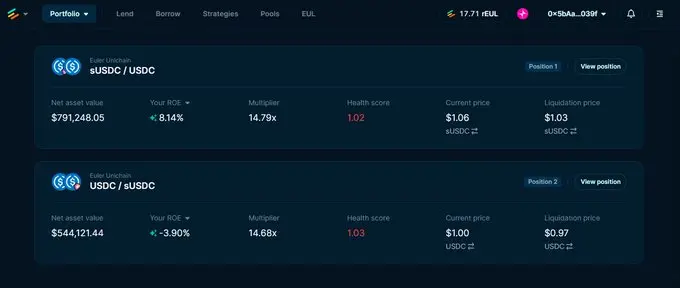

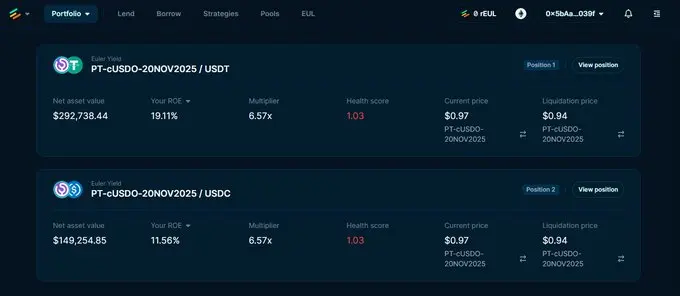

The next source of revenue is Euler Finance’s Spark mining activity on Unichain, from which OP token incentives can be obtained.

Under the current circumstances, the annualized rate of return is 27% (Euler does not display OP rewards), which is actually quite high considering the relatively low risk.

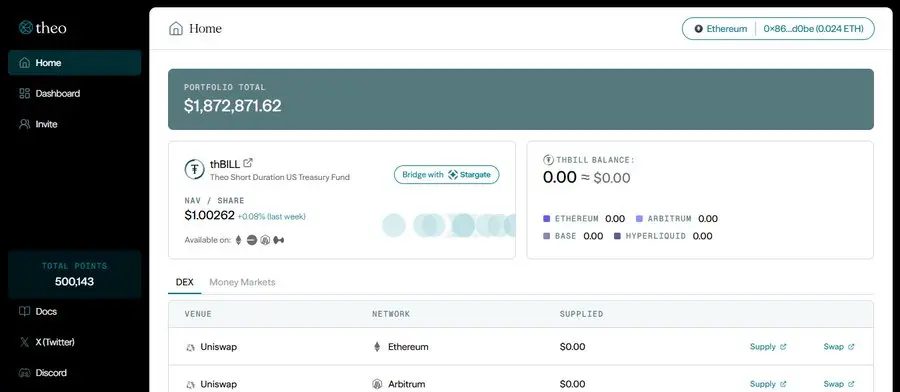

The next one is Theo Network, a new player that just went online not long ago.

They've introduced a points system, which I'm very optimistic about.

There are no private PY transactions, so everyone can participate with peace of mind and will not feel cheated.

Pray that the annualized rate of return can reach 30%

Next up is Neutrl. This project hasn’t officially launched yet, but it offers a private transaction with different options. I chose to lock my funds for 12 months to get a fixed annualized rate of return of 30%.

Maybe it will be online soon?

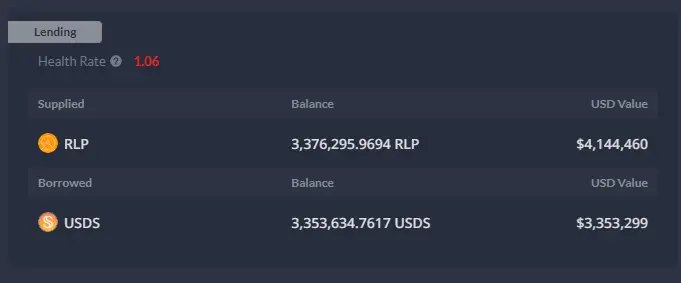

The next source of income is MorphoLabs' RLP arbitrage, which currently has an actual annualized yield of 33% (with high volatility), and has not yet included Resolv point rewards, which are expected to add an additional 10% annualized yield.

The last one is Open Eden. Although I am optimistic about this project, I have to reduce my holdings due to the decline in profitability of the revolving lending strategy due to rising interest rates (but I will increase my holdings again soon).

With an FDV of $300 million, I estimate an annualized return of approximately 50%.

$500,000 per month and an average annualized return of 78%—both of which are speculative and heavily influenced by Plasma—proved to be a very wise investment.

You May Also Like

Vitalik Buterin Pushes Ethereum Builders to Move Beyond Clone Chains

Circle unveils CCTP V2 for seamless USDC crosschain transfers with Stellar