This Whale Isn’t Stopping: $392M Ethereum Long And A Tight Liquidation Price Revealed

Ethereum has retraced to the $3,160 level following the highly anticipated FOMC meeting, where the Federal Reserve cut interest rates by 25 basis points. While rate cuts typically support risk assets, Jerome Powell’s comments added a new layer of uncertainty to the market.

By openly acknowledging the risks of weaker growth paired with persistent inflation, Powell introduced the possibility of stagflation—a scenario that historically challenges both equities and crypto. As a result, sentiment across the market remains fragile, and investors are struggling to interpret what this macro shift could mean for Ethereum’s next move.

Despite the volatility surrounding the decision, one major whale continues to act with conviction. According to Lookonchain, the Bitcoin OG who famously shorted the market during the October 10 crash is once again doubling down on his bullish Ethereum position.

Instead of taking profits or reducing exposure after the recent rally, he has continued accumulating aggressively, signaling a strong belief in ETH’s medium-term trajectory even as broader sentiment turns cautious.

Whale Position Ramps Up, But Risk Is Rising

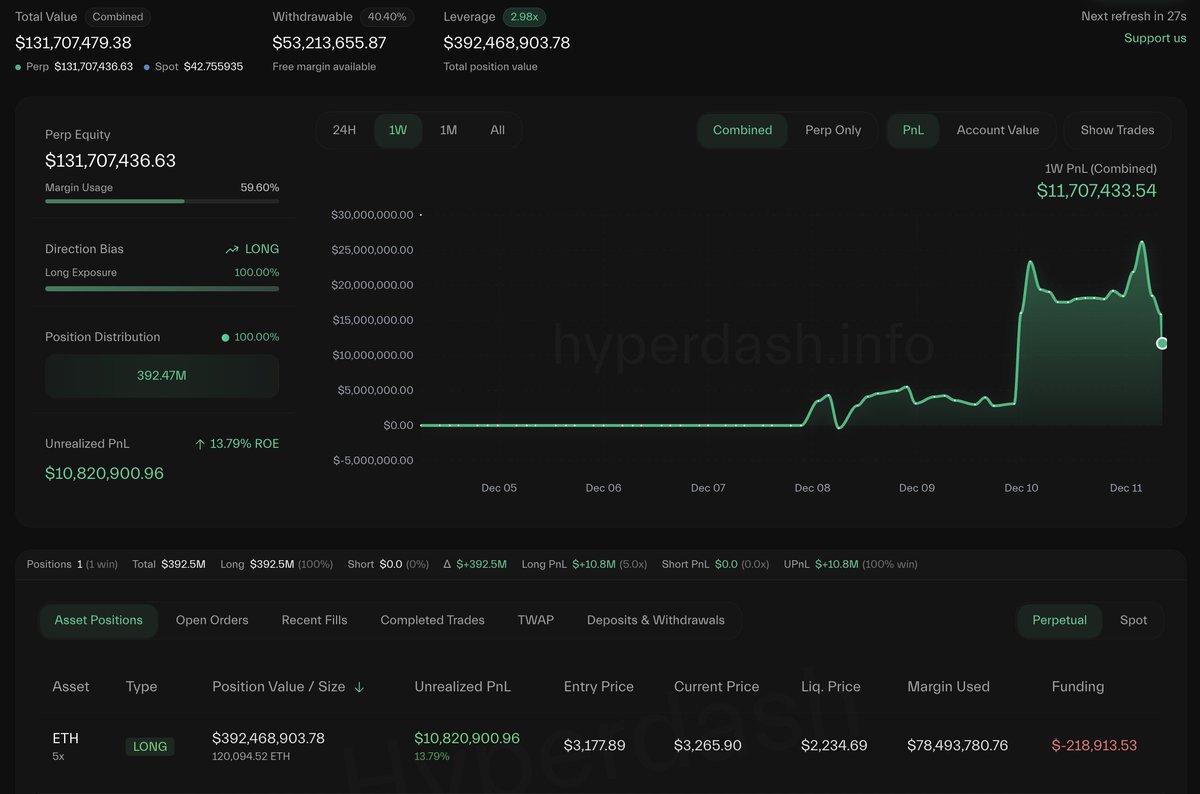

According to Lookonchain, the whale’s position has now surged to 120,094 ETH, valued at approximately $392.5 million. With a liquidation price at $2,234.69, this has become one of the largest and most aggressive long positions currently tracked on-chain.

Such a massive allocation signals extreme conviction, especially coming from the same Bitcoin OG who successfully shorted the market during the October 10 crash. However, the scale of this bet also highlights how much risk is now concentrated in a single directional position.

The liquidation price is a key concern. At $2,234, it sits nearly $1,000 below current levels, but in highly leveraged environments—especially during macro uncertainty—prices can retrace violently. Ethereum has already shown a tendency toward sharp intraday moves, and with funding rates rising and leverage across the market stretching to historical highs, even a moderate correction could trigger cascading liquidations.

If ETH experiences a sudden spike in volatility due to shifting macro conditions, a negative reaction to the latest FOMC decision, or a broader market unwind, the whale’s position could come under significant pressure. While large whales often influence market sentiment, this setup illustrates how thin the margin for error has become.

ETH Testing Resistance While Momentum Weakens

Ethereum has retraced to the $3,196 level after failing to hold above the $3,300 zone, signaling that bullish momentum is beginning to weaken. The daily chart shows ETH rejecting the red 200-day moving average, a key long-term trend indicator that has acted as resistance throughout the recent downtrend. Until ETH breaks and closes decisively above this level, the broader structure remains vulnerable.

The 50-day moving average is still sloping downward, reflecting persistent selling pressure despite last week’s rebound. Meanwhile, the 100-day moving average sits well above the current price, reinforcing the heavy overhead resistance ETH must overcome to reestablish a bullish trend. Volume has also declined compared to the early December bounce, suggesting buyers are losing strength as price approaches major resistance levels.

Related Reading: Bitcoin Exchange Reserves Fall To Lowest Levels on Record: The Bullish Signal Most Traders Are Missing

Structurally, ETH remains in a mid-term downtrend, forming lower highs and lower lows since September. Although the recent push from the $2,800 region shows buyers defending key support, the rejection at $3,350 highlights that sellers are still in control at higher levels.

If ETH fails to regain the 200-day moving average soon, a retest of the $3,050–$3,100 support range becomes likely. Conversely, a strong reclaim above $3,350 could open the door for a move toward $3,500, but the market will need renewed momentum to get there.

Featured image from ChatGPT, chart from TradingView.com

Ayrıca Şunları da Beğenebilirsiniz

BitGo expands its presence in Europe

XRP price weakens at critical level, raising risk of deeper pullback

Copy linkX (Twitter)LinkedInFacebookEmail