SoFi Makes History: First U.S. National Bank to Issue Stablecoin on Public Blockchain

SoFi has become the first U.S. nationally chartered retail bank to issue a dollar-backed stablecoin on a public, permissionless blockchain, marking a turning point in how regulated banks participate in on-chain finance.

The company announced the launch of SoFiUSD, a fully reserved stablecoin issued by SoFi Bank, N.A., positioning the bank not only as a consumer-facing issuer but also as an infrastructure provider for other banks, fintech firms, and enterprise platforms.

SoFi Brings Stablecoins Inside the Banking System

According to SoFi, the stablecoin is live for internal settlement activity and will be made available to SoFi members in the coming months.

The launch places SoFi at the center of a fast-moving shift in U.S. financial regulation, where federal agencies are beginning to formally integrate blockchain-based payment instruments into the banking system rather than treating them as an external risk.

SoFiUSD is issued directly by SoFi Bank, an OCC-regulated and FDIC-insured depository institution, and is backed one-to-one by cash reserves held at the Federal Reserve.

That structure seeks immediate redemption while avoiding credit or liquidity risk tied to commercial paper or other yield-bearing instruments.

As a national bank, SoFi is required to provide certified reserve reporting under the rules established by the Guiding and Establishing National Innovation for U.S. Stablecoins Act, or GENIUS Act, which was signed into law in July 2025.

GENIUS Act Ends Years of Stablecoin Uncertainty for U.S. Banks

The GENIUS Act created the first comprehensive federal framework for payment stablecoins in the United States.

It permits insured depository institutions to issue stablecoins through approved structures, provided they meet strict reserve, disclosure, and supervisory requirements.

Updated guidance from the OCC and FDIC followed in the months after the law’s passage, explicitly allowing banks to engage in stablecoin issuance, custody, and tokenized settlement under a defined rulebook.

That clarity reversed years of uncertainty that had previously forced SoFi to pause its crypto services in 2023.

SoFi said the stablecoin will be used across a range of settlement functions, including crypto trading, card network settlement, merchant payments, and international remittances.

For users in countries with volatile currencies, the company plans to support SoFiUSD as a dollar-denominated balance within debit or secured credit products.

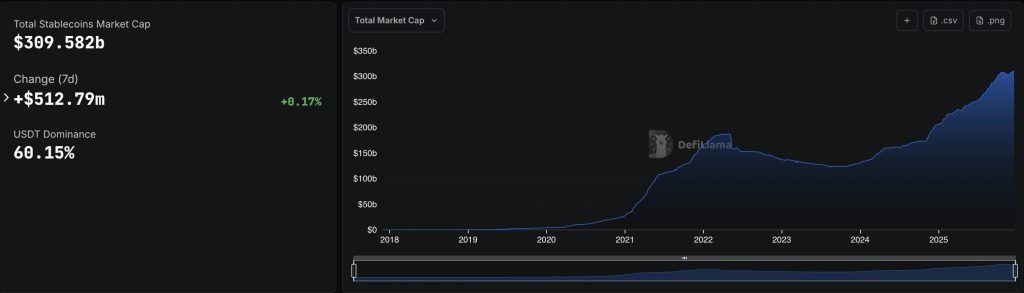

The launch comes as the stablecoin market continues to grow rapidly. Data from DefiLlama shows the total stablecoin market capitalization at roughly $309 billion, with Tether’s USDT accounting for more than $186 billion and Circle’s USDC close to $78 billion.

Source: DefiLlama

Source: DefiLlama

Analysts project that the global stablecoin market could exceed $3 trillion by 2030, driven by demand for faster settlement, lower-cost cross-border payments, and access to dollar liquidity outside the traditional banking system.

Stablecoins Step Into the Mainstream as U.S. Oversight Tightens

Regulatory momentum has accelerated alongside market growth. On December 16, the FDIC approved a proposed rule outlining how FDIC-supervised banks can apply to issue payment stablecoins under the GENIUS Act.

The proposal establishes a formal application process and confirms that only approved entities, known as permitted payment stablecoin issuers, can issue such assets in the U.S.

Earlier this month, the OCC also conditionally approved several crypto firms, including Circle and Ripple, to pursue national trust bank charters, bringing more digital-asset companies under a single federal supervisory framework.

Ayrıca Şunları da Beğenebilirsiniz

U.S. Court Finds Pastor Found Guilty in $3M Crypto Scam

MSCI’s Proposal May Trigger $15B Crypto Outflows