Uniswap Fee Switch Set to Trigger Historic Token Burns as Vote Passes — Can UNI Reach $10?

The Uniswap community is on the verge of approving one of the most consequential governance decisions in the protocol’s history, with a vote to activate the long-debated fee switch and burn a large portion of UNI tokens set to pass later this week.

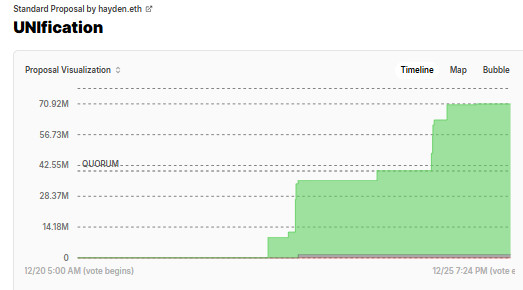

The proposal, known as “UNIfication,” has already crossed the required quorum, is backed by overwhelming support, and is set to go live following a short time-lock period.

Notably, this will set the stage for changes that would directly tie Uniswap’s protocol activity to the UNI token’s supply dynamics for the first time since launch.

Uniswap Vote Nears Finish With Overwhelming Support

As of early Monday, more than 69 million UNI tokens had been used to vote in favor of the proposal, far above the 40 million required for approval.

Voting opened on Dec. 20 and runs through Christmas Day, though opposition has been negligible. Only around 740 votes, roughly 0.001% of those cast, were against the proposal, while about 1.5 million UNI were marked as abstentions.

Source: Uniswap

Source: Uniswap

More than 6,000 addresses have participated, with support hovering near 100% among active voters.

Uniswap Labs CEO, Hayden Adams said once the vote formally closes, the changes will be subject to a two-day time lock before implementation.

The proposal also authorizes the immediate burning of 100 million UNI from the Uniswap Foundation’s treasury.

The governance package also introduces a Protocol Fee Discount Auctions system designed to improve returns for liquidity providers while aligning Uniswap Labs, the Uniswap Foundation, and on-chain governance under a single legal structure using Wyoming’s DUNA framework.

Several influential figures in decentralized finance backed the UNIfication proposal, including Variant founder Jesse Waldren, Synthetix and Infinex founder Kain Warwick, and former Uniswap Labs engineer Ian Lapham, all of whom hold substantial voting power.

Can the Fee Switch Finally Give UNI Holders a Direct Payoff?

The vote comes amid wider debate across DeFi about sustainable token economics and long-term value capture.

Many protocols have struggled to translate heavy usage into tangible benefits for token holders, a criticism that has followed Uniswap for years despite its dominant market position.

Uniswap remains the largest decentralized exchange by volume, having processed more than $4 trillion in trades since launching in 2018, yet UNI holders have historically had limited direct exposure to protocol revenue.

Supporters of the fee switch argue that tying protocol revenue more directly to UNI supply dynamics could reshape that narrative.

The market reaction has been swift. UNI has gained roughly 25% since voting began, trading near $6.08 after recovering from a month-long slump that pushed the token to a seven-month low of $4.88.

Earlier signs of the proposal in November sparked an even sharper move, with UNI climbing close to 40% in a matter of days and briefly touching $9.70 on Nov. 11 before broader market weakness set in.

Can UNI Reach $10 Before the Year End?

According to CoinGecko data, UNI is currently the 38th largest cryptocurrency by market capitalization, valued at around $3.8 billion.

From a technical perspective, UNI’s price action has drawn renewed attention as the governance process nears completion.

The token recently bounced from the lower boundary of a multi-year ascending channel that has guided its recovery since the post-2021 drawdown.

Analysts tracking the structure note that this zone has historically acted as strong demand, with each retest followed by higher reaction highs.

In the near term, UNI faces resistance around the $6.80 to $7.20 range, with heavier supply clustered closer to $9 and above.

Ayrıca Şunları da Beğenebilirsiniz

Adoption Leads Traders to Snorter Token

New Crypto Investors Are Backing Layer Brett Over Dogecoin After Topping The Meme Coin Charts This Month