Airdrop

Share

An Airdrop is a distribution of free tokens to a community, typically used as a marketing tool or a reward for early protocol adopters and testers. In 2026, the "points-to-airdrop" model has matured into merit-based incentive programs that utilize Sybil-resistance and Proof-of-Humanity to filter out bots. Airdrops remain a primary method for decentralized governance (DAO) bootstrapping. Follow this tag for the latest on retroactive rewards, eligibility criteria, and how to participate in the most anticipated token distributions in the ecosystem.

5438 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Status, Mechanics and How to Buy

Author: BitcoinEthereumNews

2025/10/10

Share

Recommended by active authors

Latest Articles

Now It Is Official: Analysts Consider the Dollar a ‘Dangerous’ Asset

2026/02/08 17:31

The author of "Rich Dad Poor Dad" responds to criticism: He will continue to increase his holdings of Bitcoin and gold; investors should focus on asset value.

2026/02/08 16:59

What’s new in refiled impeachment complaints vs Sara Duterte?

2026/02/08 16:58

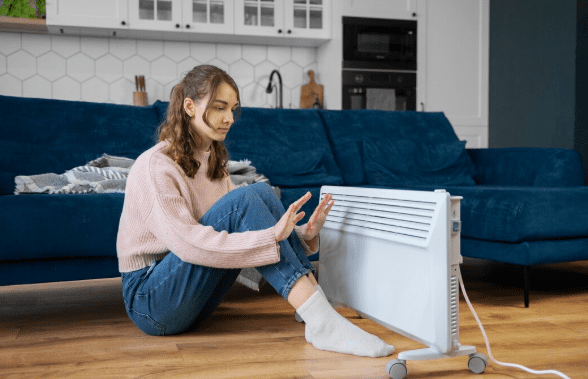

Space Heaters Explained: How They Work and When to Use Them

2026/02/08 16:54

XRP koers veert op: whales en netwerkactiviteit geven een nieuw signaal

2026/02/08 16:46