Launchpad

Share

Launchpads are decentralized platforms that facilitate early-stage fundraising for new Web3 projects through Initial DEX Offerings (IDOs). They provide investors with curated access to token sales while offering startups a community-driven capital injection. In 2026, launchpads have evolved into full-stack incubators, focusing on project quality and long-term sustainability. Follow this tag for the latest in token distribution models, tier-based participation, and the emergence of the next generation of "unicorn" protocols across various blockchain ecosystems.

2946 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

![Investors Rush In – 5 Best Cryptos to Buy Right Now for Massive Early-Stage Gains [October Edition]](https://coindoo.com/wp-content/uploads/2025/10/moon-hott.png)

Recommended by active authors

Latest Articles

“cnjrefcod” 30% Off Trading Fees

2026/02/07 06:42

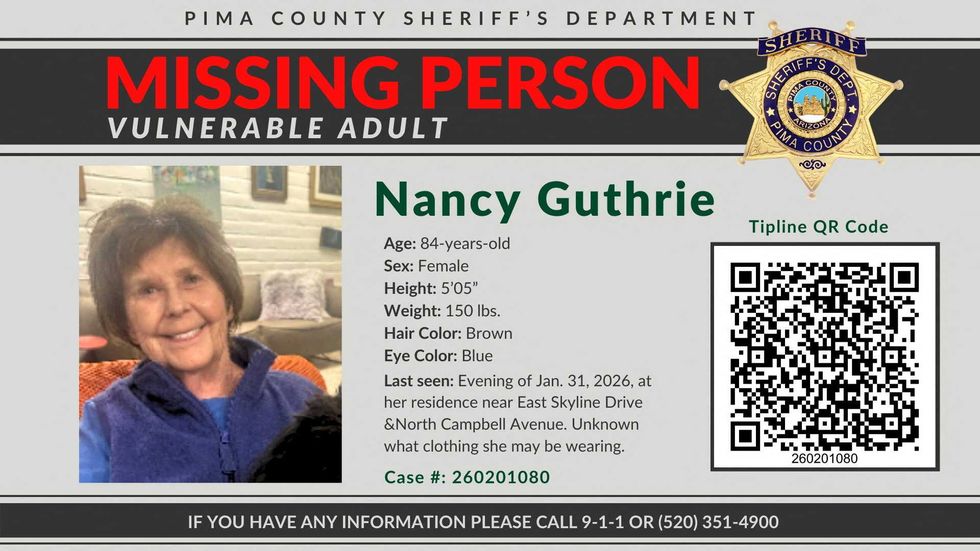

New note emerges in abduction of Nancy Guthrie

2026/02/07 06:32

Stablecoin Inflows Surge as Bitcoin Struggles Under Persistent Selling Pressure

2026/02/07 06:04

XRP snaps back after near-20% sell-off as volatility dominates post-crash trading

2026/02/07 06:03

Stellar (XLM) Jumps 7% as $0.183 Breakout Signals Potential Reversal

2026/02/07 06:00